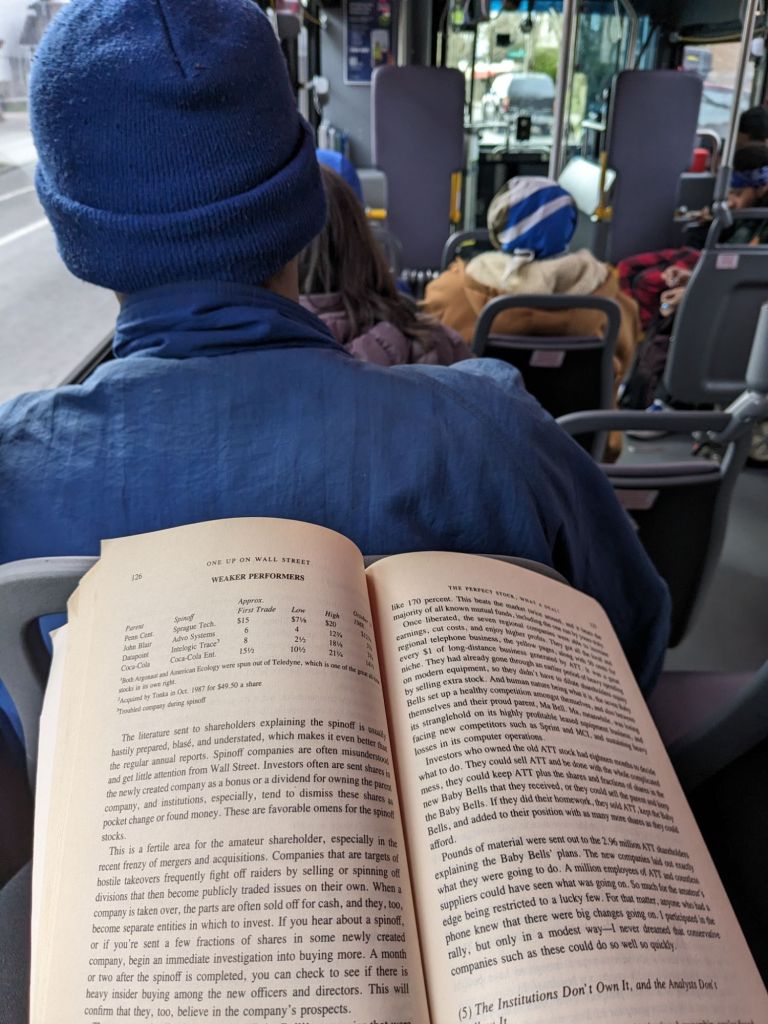

As I was on the bus headed to pick up some groceries, I was reading Peter Lynch’s One Up On Wall Street. There is a part where he talks about diversification, he calls its diworseification, because as human nature would have it, people often get ahead of themselves and make rash decisions.

We often forget that people are running these large corporations when we get into the conversation of greed, capitalism etc, that for an investor starting out, they might have the cognitive dissonance of the stock market, the company itself and the people running the company.

As I was reading this section of the book I couldn’t help but have a good chuckle, as it clicked in my head, that no matter how big a business or company grows, at the end of the day, people are people and sometimes the person at the head of the company will make a rash decision derailing the whole company.

For example, imagine if someone came in with years of experience and took over Coca-Cola and within a few months felt pressure from the outside about how unhealthy their sodas are. One night after pillow talk with their partner, they have what they like to think, is a light bulb moment. ‘I am going to buy out an upcoming seaweed company, and other healthy snacks, then we are going to aquire a gym franchise.’

Soon the balance sheet has a franchise gym along with a healthy snack company sitting on it. In order to get the word out, the company is now taking money from the profits of the company instead of buying back shares or sending dividends out to shareholders. Instead, spending the profits, so that the acquisitions stand a chance and don’t flounder right out the gate.

Several earnings reports later and awful performance metics – the head of the company realises that their customers don’t care to workout at a gym owned by Coca-Cola, all they care about is their soda. Furthermore, evidence might show that most of their original customer base doesn’t go to the gym at all and those that do probably aren’t reaching for packs of Coca-Cola, outside the exceptional few.

The head of the company realises this was a blunder and begins the sell off the cost consuming gym acquisition while finding a chance to salvage the healthy snack component.

This fiction story isn’t at all uncommon in the real world of investing and according to Peter Lynch it happens every second decade ( of course it could be different now, the book was written in 1989) but the point remains the same.

When I watch Shark Tank I can often tell when someone is going to leave without a deal…

- It is usually when someone has a good idea, but is all over the place and diversifying with multiple products taking away all attention from their MVP.

- Someone who is just too early in their journey.

- Someone that doesn’t have an investable business but will do well focusing on it as a side hustle income.

- Someone that refuses to believe that their idea isn’t worth $500,000 for 2% right out the gate.

And of course there are other reasons.

You would think the first example would only plague those starting out, on the grind searching for investors, but nope, even those who manage companies worth billions of dollars can still make the same mistakes.

After all, humans are humans no matter what position you put them in.

Which is why it is often argued, not in the politest way, that in the world of investing, you want to own a company that an idiot can run because sooner or later, one will run it.

Leave a comment