There are those defining moments in life. The moments you use to wait and wish for during some of your darkest hours. And I had one of mine today. I've been taking a personal finance class at the University of Washington Tacoma, taught by two Professors, Kirk Mandlin and Dean Bennion. Tonight was the first... Continue Reading →

Skin in the Game: Why Compounding Efforts Look Like Magic From the Outside

What People See vs. What Built It From the outside, people sometimes assume I have it all together. They see my straight A’s as a student. They see my global blog that reaches readers in dozens of countries. They hear that I have an investment fund. And the conclusion they jump to is: That I'm... Continue Reading →

My Version of “Cold Lamb Sandwiches”, and the Love I Believe In

https://youtu.be/2zmaZ19ufZU?si=FtjdxAb-Ru69theR Push play and listen to this while reading, I promise it won't disappoint. Last night, I stayed up talking to a friend until two o'clock in the morning. She was opening up about a situation she was in, and I was sharing something I’d recently experienced. We got to talking about what we want... Continue Reading →

I Turned 35 This Year: The Plan, Healing, Building, Living, Giving

Tonight, as I was reading various blog posts on retirement and saving money, I got to a Reddit post where somebody asked if they were starting too late at 37. And people were quick to tell them, “No. I started later.” One even said they had to start over at 43. And it made me... Continue Reading →

Dear Readers: This Blog Has Now Reached Over 50 Countries Worldwide

Dear readers, This blog has now reached over 51+ countries, and I'm honored to have each and every one of you here. If you're not from the US, it's important to know that financial advice is not a one-size-fits-all approach. So it's important to understand that what might look great on a post might not... Continue Reading →

Building Peace in a Loud World: Why Safe Spaces Matter More Than Ever. Part II

This is Part II to Why I’m Building a Life That’s Safe From the Noise, if you haven't read part I, I encourage you to read it first. With that said there’s a certain kind of exhaustion that doesn’t come from work or school or even parenting, it comes from being constantly surrounded by ignorance.... Continue Reading →

Why I’m Building a Life That’s Safe From the Noise

There’s a lot going on right now. Wars overseas, continuous cost of living increases here at home, funding shortages, and policies under the current administration that don’t seem to be helping people at all. https://youtu.be/Tc5W_3r4tew?si=YBwoGkp_QrUMFp6Q This is one of the pieces I have been listening to this week. Every time you turn around, there’s something... Continue Reading →

It Started with a Letter to Santa: Eggnog and a Million Dollars, a Life of Investing

I once wrote a letter to Santa that said, “All I want is a box of eggnog and a million dollars.” I spelled my name backwards in the signature because I was that young and dyslexic. My mom saved it. I threw it away later in a PTSD-driven moment trying to forget my childhood. But... Continue Reading →

Graduation Without the Gown: Quietly Celebrating Milestones in Your Own Way

Today I graduated. The weather didn’t make a scene about it. No grand speech, no band playing. I didn’t put on a cap and gown. I didn’t walk across a stage or pose for pictures with extended family. None of that happened. I was at home. I went to the mall, bought some chocolates, and... Continue Reading →

A Season of Change: Investment Progress, Personal Loss, and What Comes Next

Mid-Year Investment Fund Update It’s been a while since I’ve updated you readers on the investment fund. It now sits at $2,061 as of today, as the market continues to churn at the hands of the president and the chaos that has been coming out of Washington since January. Still, I am over halfway to... Continue Reading →

My Journey: From TCC Graduate to UW Tacoma Student

The End of a Chapter: Graduating from Tacoma Community College This might end up being a long blog post, so bear with me. Where do I start? Well, I graduated from Tacoma Community College ( Official ceremony/graduation will be in June). Friday marked the official end of the winter quarter. I took my final exams... Continue Reading →

My 200th Post – A Reflection on My Financial Journey, Ownership, and Designing Life with Intention

When I First Started on My Finance Journey This will be the 200th post for this blog, and I think it's an important milestone to set aside some time and reflect. Back in 2018, I wasn’t in a stable financial place. I didn’t have a pot to piss in, so to speak, but in better... Continue Reading →

Why I Became an Investor and Started the Broke College Student Blog

The scary truth and the real reason why I live like a broke college student even when I don't have to is rooted in a time in my life when the saying "I don't have a pot to piss in" was painfully true. I was terrified to my core during a period when my income... Continue Reading →

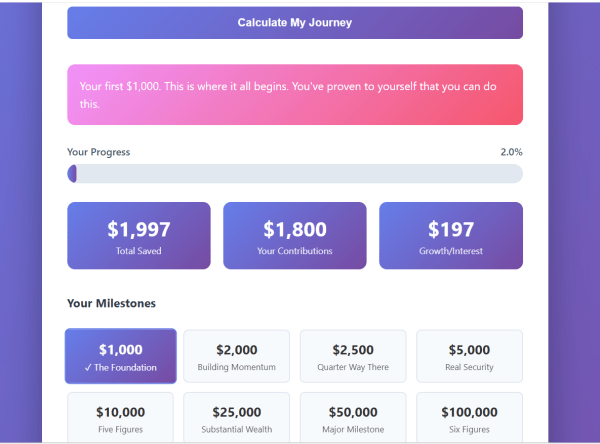

Track Your Journey From Broke to Building Wealth- Free Calculator Inside

I Built a Free Wealth Calculator (And You Can Use It Right Now) I've been writing about building wealth from nothing for a while now. Talking about the milestones, the mindset shifts, the compound effect of showing up month after month. But here's the thing: it's one thing to read about the journey. It's another... Continue Reading →

Year-End Reflections on Money, Growth, and Learning to Protect Your Energy

At the beginning of this year, I wrote about losing my mentor and still holding onto a sense of excitement for how the year might end. It’s safe to say that the year is ending on a higher note, though some of the same somber undertones are still there.I’m officially on winter break now. I... Continue Reading →

Honoring My Late Mentor on a Monday Afternoon, While Reflecting on Wealth Building

It's a Monday late noon, and I am sitting in a café that myself, my mentor, and my son used to frequent together. I hadn't stepped in it since the beginning of the year, and when I did, it was only for a brief while to get food to take home. However, as the kid... Continue Reading →

Finding Home in Finance: A Reflection on Habits, Patience, and Mastery

There comes a moment in life when things click into place. For me, it wasn’t a sudden epiphany; it was a slow dawning, a series of small wake-up calls that finally added up. I’ve been in school since April 2024, putting every ounce of energy into my classes, trying to prove something to myself, maybe... Continue Reading →

Portfolio Autopsy: Coca-Cola (KO): How a handful of slow, steady purchases turned into a 37% return and a compounding machine.

It's that time of year again ( the holidays), and as always, I've found myself looking at our first-ever serious investment that happens to be the Coca-Cola Company. There are stocks you buy for excitement, and there are stocks you buy to sleep well at night. Coca-Cola is the latter. It’s the kind of company that... Continue Reading →

How Administrative Overreach Creates Ripple Effects Across Universities, Communities, and the Entire Economy

Have you ever watched one small thing happen and realized later it wasn’t small at all? That’s exactly what happened to me recently. I was at an event where there’s usually a full hot lunch, catered trays, real meals, the whole setup. But this time? Snacks from Costco. No catered lunch. Instead, there were: granola... Continue Reading →

Helping the Ready: What the $300 Dog Taught Me About Letting Go

(A Reflection on Financial Readiness, Boundaries, and Emotional Bandwidth) Realizing You Can’t Help Everyone Financially I used to think that if you cared enough, you could help anyone. I don’t believe that anymore. Recently, a friend of mine was thinking about adopting a dog as a Christmas present for her son, a $300 expense, while... Continue Reading →

Letting Go of Perfection This Fall: Building Wealth, a Life, and a Heart That Can Hold It

Fall always does this to me, the air turns crisp, the trees start letting go, and suddenly it feels like the season is asking you to reflect, too. I’ve been rearranging my furniture, cleaning my place, and feeling grounded again. Tonight I’ve had soft music on, the kind I used to play during seasons of... Continue Reading →

Why People from Hard Backgrounds Are the Prime Targets of MLMs (And What No One Tells Them)

When you’ve spent your whole life just trying to survive, the first time you can breathe feels like wealth. You’ve paid down a few bills, maybe built a small cushion. For once, you’re not checking your bank app every morning to make sure you didn’t overdraft. That small moment of peace is exactly when the... Continue Reading →