Note to readers before reading: I deleted this post on Medium from the days when I would document my journey on there. I wrote this on Jan 30th, 2022. But now republishing it on here 7/19/2024 and will be adding additional updates for this article at the bottom.

I purchased my first share of the Hershey Company on June 16th, 2020, for a price of $132.87, and it was a purchase that I was happy to make.

Since I’ve become an investor, my excitement does not come from buying materialistic things that sit around the house. Instead, it comes from creating positions in companies.

A bit of history about the Hershey Company.

It was founded in 1894, in Derry Township, PA, by the founder Milton S. Hershey, and as the obvious went, the rest became history.

I won’t bore you with all the details, but I will share some fun facts, because who doesn’t like to read about chocolate?

That is of course being the next best thing after eating it.

Here are three fun facts.

- The Hershey bar formula that we have come to love was created in 1900.

- Reese’s cup shapes came from using baking tins.

- During 2020 Hershey saw their sales increase significantly due to families baking at home. Products like cocoa powder, chocolate syrup, baking chips were the power behind a great percentage of their sales that year.

And now, I want to share this fact with new investors or college students looking into the world of ownership through stocks.

If you go to investor relations on the Hershey site, you will find their annual report, and here is what that looks like.

Gone are the days when it was easy to get hard copies sent to your mailbox and actual stock certificates with your name on them, but the research and learning are still critical components on your journey to becoming an investor.

Why do I have such a personal love for owning shares of chocolate?

Because I am from a city that is known for chocolate factories, here is a hint, Mars was founded here before moving to McLean, Virginia, and another famous chocolate brand still has its factory here.

The chocolates come in a pink tin and are wrapped with tin foil. You usually find them next to my number one favorite chocolate, Ferrero Rocher.

If you can guess the chocolates that I am talking about leave a comment below, I love to engage in conversations.

Being surrounded by chocolate history and growing up with a deep-founded love for it, it wasn’t long before I started looking into chocolate companies I could acquire ownership.

Hershey was the first one that came to mind, and I staked a position I will always hold.

When you buy shares of certain companies they should be passed down like heirlooms, and Hershey, in my opinion, is one of those companies that long after I am gone, will be passed down to my son, and his children, if we are fortunate to still have the solid company around that long.

Can you imagine a world without Hershey?

How has Hershey performed in my portfolio?

So far, it has returned me an excellent percentage, and it has been solid, meaning it has been a stable position even during this time with the volatility in the market.

In addition, the dividend itself has increased since we began receiving it, which is always allocated to shares in our portfolio.

Hershey is another blue chip company that has a solid track record and has been around for generations.

For new investors the word blue chip means matured companies that are stable and solid, and have proved their place in the world.

What goal do I have for my Hershey shares?

Moving forward, I would like to accumulate more shares when the time is right and perhaps even start what I would call “A Chocolate Portfolio,” where nothing but sugary chocolate confections make up the whole portfolio.

So think of companies like Hershey, Nestle, Mondelez, and others if they ever become publically traded.

If Ferrero Rocher ever went public with limited shares, you best believe I would be one of the first people in line with a fistful of cash waiting to put my name on some of those shares.

And, you can believe the same would go for Mars. Who doesn’t love a good ol’ snickers from time to time?

In Conclusion

Adding mature, stable companies to your portfolio can’t hurt, especially if you are a long-term investor with the stomach to hold during challenging times in the market.

With that said, in the following article, I want to write about how our behavior can make us better investors and all-around better humans in other areas of our life.

When it comes to investing your behavior will be one of the contributing factors between returns and losses.

I enjoy writing articles about companies in our household accounts, and I hope to sprinkle in different perspectives and insights down the road.

I believe that perspective makes a difference when buying up shares of a great company. It is a beautiful thing to realize that your cash is contributing to society through products which then make a difference.

Each time someone bites into a hershey bar, a half of cent of your investment made that possible.

Each time a grandmother bakes a chocolate cake for her grandchildren using hershey cocoa powder, a small percentage of your capital contributed to that memory being created.

When you view your investments as more than just cash contributions, you’ll find that investing becomes more than just a way to build wealth, it becomes this intricate part of contributing to society’s desires and wishes.

With that said, I hope this read was pleasant, and until next time, wishing you all health, wealth, and all-around wellness.

Additional insight for this article updated for today

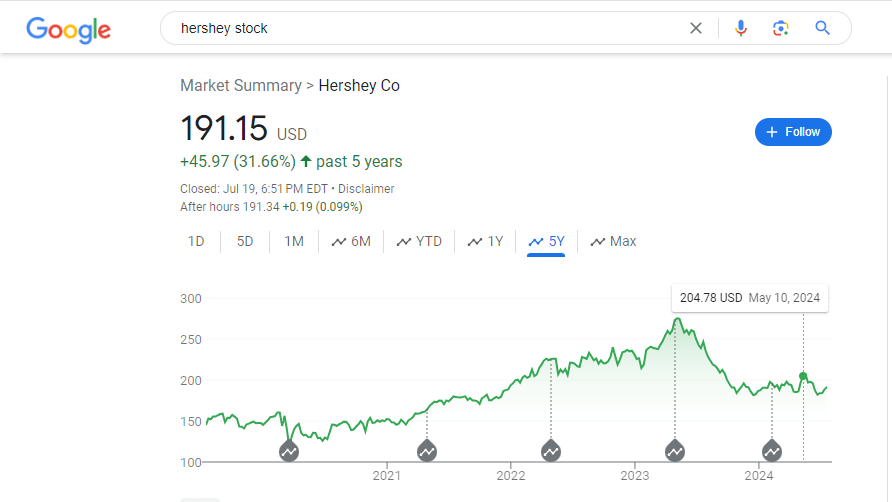

Today as of writing this section of the article Hershey is $191.15 a share. Price per share is up from when I first purchased shares back in 2020 at $132. Price per share of the Hershey company peaked at $275 May 2023.

I never sell out of positions and rarely check my personal portfolio unless I am adding to a position or concerned about a position. So when it peaked at $275 I don’t think I was even aware, though I knew it had hit the $200s.

I currently hold 2.2021 shares in my old portfolio and have been reinvesting dividends. I haven’t purchased any more shares since writing the first half of this article as I switched my focus from building a mature blue chip defense portfolio to a growth portfolio at that time.

Being young I wanted to be more aggressive and have some skin in the growth sector. I had started a new portfolio and it has grown nicely thanks to the addition to a certain ETF even with the sore spot of Disney shares tanking and dragging down the growth portfolio.

I have come to appreciate some companies and stocks as semimetal holdings but never to the point I wouldn’t sell them if the fundamentals of the business changed. I am grateful to hold onto them and allow the shares to appreciate while dividend’s continue to purchase ownership of the chocolate confectionery inch by inch.

Perhaps I will wake up one day and find myself allocating some funds towards the delicious chocolate Hershey company once more. In the mean time that will have to wait as I build the investment fund away from personal household accounts.

UPDATE

A day after writing this a favorite investor and ‘mentor’ posted an article on his personal blog about blue chip stocks and included a bit about the Hershey company (HSY) which you can find here among hundreds of articles revolving around finance and investing. I learned a lot from his personal thoughts and knowledge that he has been generous in sharing over the years.

I will be doing some further research for my own personal portfolio on certain blue chip companies and thought it was beautiful timing that his input was published as well around the same time as mine. Remember that whenever you read a blog or website that nothing is to be taken as financial advice including this site and the sites that I link to and or share. It is of upmost importance that you do your own research outside of reading blog articles which do not count.

Leave a comment