Today, for the first time in a while, I logged into my Charles Schwab account and reviewed the dividend history for my first investment account. I wanted to check the recent dividends paid out, and to my pleasent surprise, Coca-Cola had paid dividends at the beginning of this month.

When I looked closer, I noticed we hit a significant milestone: our reinvested dividends are now enough to buy an additional share of Coca-Cola at no additional cost to us through investing extra principal. Our dividends now cover the cost of one share of Coca-Cola, demonstrating the power of dividend reinvesting.

This is where your wealth grows—when you can reinvest dividends to buy additional shares without putting in more of your own money. This doesn’t mean you should stop investing, but it shows that your money is compounding over time without additional effort. This is the first time we’ve achieved this milestone with our investments.

I’ve written about this before, but the first time I bought Coca-Cola stock was in February 2020, right before the pandemic. I remember purchasing two shares at around $55 each and watching their value drop as the pandemic unfolded and people began panicking and selling off their investments. As I write this I recall two distinct moments from that year.

The first was while I was on the local train with a family member, heading to grab lunch. I told her I had invested in Coca-Cola for our household, and I distinctly remember how I felt as I pushed the button to confirm the purchase. I told her, “I did it. There’s no going back. I’m committed to this.”

I’ve done my research, and even though I had some doubts because I had never invested at this level before, I knew this was the right move. The second moment was seeing everything in the market turn red and trusting that what I had read and learned would hold true over time. It did.

As years passed, the companies I bought at a discount during the pandemic surged in value and continued to perform well. These investments laid a solid foundation for our financial security, giving us peace of mind knowing that our investments and dividends are working for us while we sleep and continue to build our wealth.

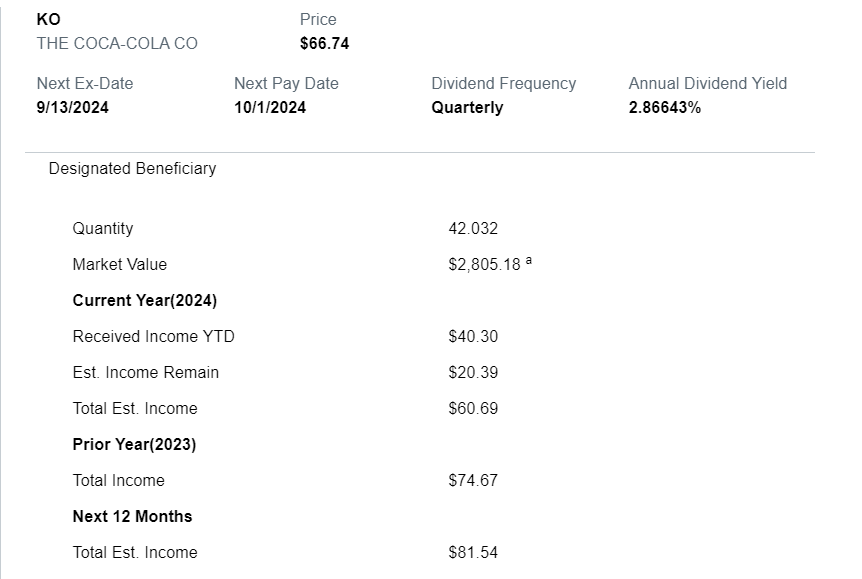

If you look at the image above, you’ll see that the income received so far this year for Coca-Cola, ticker symbol KO, is $40.30, with remaining income for the year at $20.39, bringing the total to $60.69.

In comparison, last year we received $74.67, which covered the cost of one share of Coca-Cola. For the next 12 months, the projected total income is $81.51, allowing an additional share of Coca-Cola through dividend investing moving forward.*

This goes to show that the power of dividends over time is unmatched, especially when you allow time to compound your efforts. Unless you truly need to live off your dividends or require them for some reason, the best approach is to leave them untouched.

This avoids interrupting the compounding process. As Isaac Newton said, “An object in motion stays in motion unless acted upon by an outside force,” and similarly, the growth of your investments can only be disrupted when it is interrupted.

Leave a comment