My private investment fund now has $500aum, which is halfway to the goal of $1,000 by the end of the year. I’m also happy to say that I now have an official name for it, though I won’t be divulging it here just yet.

It’s new, and I don’t have ownership of the name yet, but it’s not taken either, so I’m keeping it to myself for now. What I will say is that it reminds me of two of my favorite things that make me feel at home: one of my favorite movies, With Honors, which I’ve written about before, and my favorite season.

Hopefully, over the next couple of years, I’ll be able to tell you more about it, reveal the name, and eventually, it’ll become something that people come across overtime—over the next decade.

Until then, it’s very small, and I’m just starting out. I only began this year, and if you’ve read some of my blog posts, you’ll notice that I’ve talked about starting it from scratch—literally from pennies to where it is now.

I wanted to start it from zero, building it from the ground up, because I wanted to document the process. But also, I wanted to separate it from my personal assets that I’ve built over the years and start something new that I know can have longevity beyond my personal savings.

My personal assets are there in case something happens, and I know I can sell some to live off of if necessary. But this is something I want to keep separate, something beyond personal, that I can leave behind and build on.

New Positions Taken: Expanding the Investment Fund

Without further ado, here are some updates. I recently bought into a new position—a certain spin-off by a big conglomerate that is known for baby products and medicine.

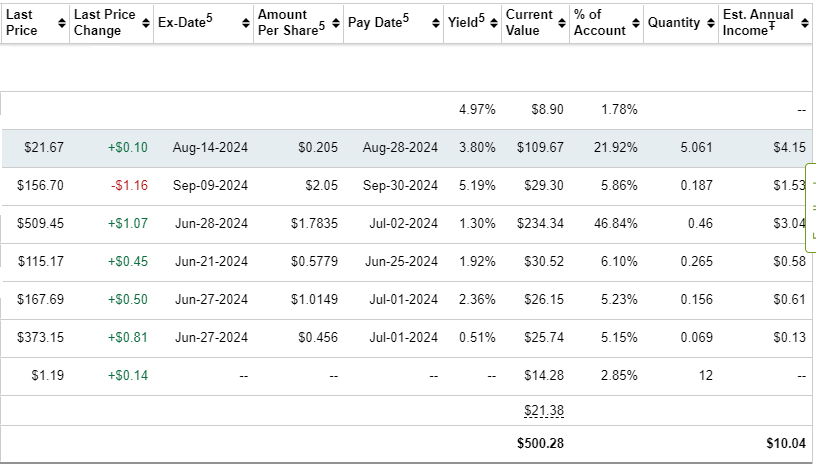

The share price went from $27 when it first spun off, down to about $17 where it settled at $18. It’s now at $21, so I’ve been picking up shares for that.

Total share amount as of today stands at 5.061. I plan on accumulating more and holding this company on the balance sheet for as long as I can.

It’s not going to make the investment fund grow significantly, but it will add some cash flow to the balance sheet, which is a nice addition to have. Even though the focus isn’t on dividends as much as it is on growth. I did, however, also add some capital to growth positions.

Right now, dividends are at $10.04 yearly. By the end of the year, I will reveal the growth that the investment fund has managed. I want to note that I’m still learning and growing into the investor I want to become.

Why Every Step Matters: Capturing the Early Stages

The purpose of this blog has always been to document my journey from the ground up both as a student and investor and to show you that you can start something small with a tiny amount of capital and build it up.

There’s a misconception that in order to become an investor, you need to have thousands of dollars, which has been proven false over time as many have started with small sums.

You have to start at zero in order to get to one, and to get to two, you first have to reach one. If you think that way, you’ll realize it’s not about how much capital you have or how much you start with—it’s about just starting.

Another reason I want to document this time in my life is because I also have a nostalgic connection to old finance movies from the 1980s and 1990s, like Trading Places and Baby Boom, or movies about someone working on a side business while in college (not the Mark Zuckerberg story,) or stories like Homeless to Harvard, where Liz Murray worked hard to graduate high school and eventually go to Harvard despite dealing with homelessness and drug-addicted parents.

Then there’s With Honors, one of my favorites, where a young man at Harvard, raised by a single mother with limited financial means, becomes consumed with the desire to succeed with honors above all else until he meets a homeless man played by Joe Pesci.

Here I am, a college student, having just started my investment fund, and I have this nostalgic feeling and the need to document this journey—not just for personal reasons, but to hopefully inspire anyone who reads this to start something of their own.

To document your process, build the life you want, design it how you want it to be, and don’t just follow the crowd because that’s what everyone else is doing. It’s okay to separate from the herd and make your own choices.

And I figured the best way to document this path was to start from the ground up with this investment fund. Honestly, during this time when prices are high and inflation is kicking everyone’s butt, including mine, living like a broke college student is something I’m choosing to do.

But I’m also finding that it’s becoming less of a choice and more of a necessity every month. I value making sure I’m not living check to check if I can help it, even though that’s becoming more likely if I don’t get my degree and continue living the way I am.

Inflation just eats away at everything now, and as a parent, I still have a teenager to be responsible for. However, I’ve taught him the basic principles of saving money and the importance of saving for tomorrow, even if you don’t think you’ll need it, because it can be the one thing that keeps you from being stuck between a rock and a hard place.

Building the Investment Fund: Plans for the Next Decade

Going back to my investments, there are a few companies that I’m comfortable with and plan to add over the next couple of months while continuing to build out some of these positions.

One thing I’ve realized recently is that investment funds often don’t play it safe like a personal portfolio might. With personal portfolios, you may hold 10 stocks, maybe 20 at most if you’re really great at what you’re doing and know the market well.

But with investment funds, there’s a lot more diversity—more of a net being cast out. I’m not saying you should take risks without doing your research or reading up on anything, but it’s also about recognizing that investment funds hold more than just a handful of stocks.

I don’t know exactly how many holdings I’ll have over the next decade, but I do know I want to build up to several positions that I’m comfortable with. However, this won’t happen over the next couple of months, except for adding a few more companies that I really want to get a position in.

Other than that, I’ll be researching, learning, and reading books—especially since I have a little over a month off before I start my next quarter of classes, which will be a full load of 15 credits.

This will take away my time to read once again, so this next month is going to be all about focusing on this blog, investing in the investment fund, and really finding my foundation for myself again in terms of fitness, health, and everything I want for myself.

So that’s the update for the investment fund.

Leave a comment