Peanut butter sandwiches are becoming the foundation of the investment fund as I allocate more capital towards it to reach my year-end goal of $1,000 AUM. This has led me to read about the J.M Smucker Company and their tight grip on Jiffy.

Growing up we were never a Skippy house or a Peter Pan peanut butter house. We were a Jiffy house through and through until things became hard and then we became a whatever peanut butter the food bank gave us household.

My household as an adult with my own child is a Kroger peanut butter honey fan because when I was little I requested peanut butter sandwiches with honey while watching Little Bear and Franklin before kindergarten.

Tonight I spent some time watching an episode of The Food That Built America titled “Peanut Butter Battle” (Season 4, Episode 9) because I knew I was going to write this article and wanted to provide a little backstory about the J.M. Smucker Company and its well-loved brand, Jif Peanut Butter.

Growing up, I always thought Jif peanut butter was the original, but it turns out Skippy was the true trendsetter in the peanut butter market. Jif actually lagged behind Skippy in sales for a while, until they came up with the slogan “Choosy mothers choose Jif.”

This makes perfect sense since my parents were from the silent generation—it’s no surprise that Jif won the peanut butter space in our pantry. When most people hear of J.M. Smucker, they think of peanut butter and jelly sandwiches—a classic, nostalgic staple of many childhoods.

However, what they may not realize is that J.M. Smucker is a much larger company than just childhood nostalgia. It owns a variety of well-known brands, such as Hostess, Folgers Coffee, and Voortman Bakery cookies.

For those of you who love pets or grew up with family pets, you’re probably familiar with brands like Milk-Bone and Meow Mix. These are just some of the food and pet brands that the company owns. Interestingly, Jif wasn’t part of the J.M. Smucker Company until 2001; before that, it was owned by Procter & Gamble.

I just learned this myself as well because I never really thought about owning J.M. Smucker’s stock therefore never dived into its history. I’m not a big fan of peanut butter and jelly sandwiches—they’re too sweet for my taste buds. If I’m going to eat something sweet, I’d rather have a Lofthouse cookie or a donut, something with a similar texture.

However, I do enjoy peanut butter by itself on toast or jelly by itself on toast—just not together, unless it’s on a pancake. In that case, I’ll put peanut butter and jelly together without hesitation over maple syrup.

Diving into Delicious Peanut Butter Profits: Exploring J.M. Smucker’s Stock Performance

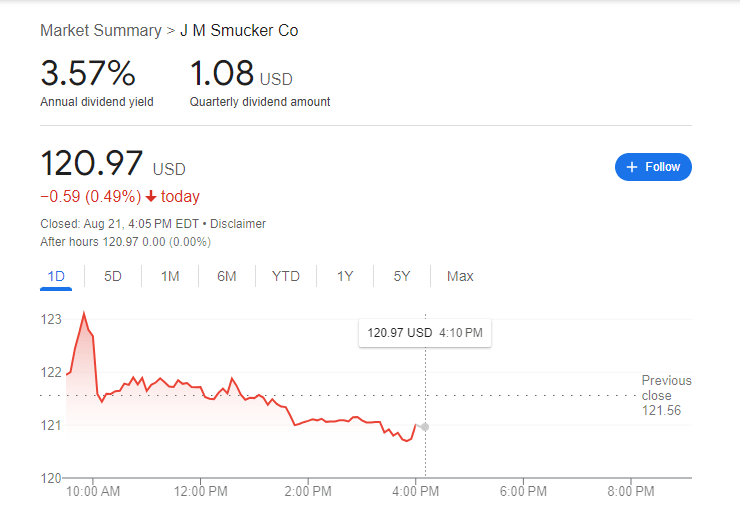

Today, the cost of owning a share of this historic 127 year old company is $120.97, at the time of writing this though it’s important to factor in any stock splits that have occurred along the way.

A couple of days ago, J.M. Smucker’s stock was sitting at $118 when I first started writing this blog post. Looking at the chart, you can see that it’s down 6.64% for the year, translating to a loss of $8.60 per share. It’s important to keep in mind that if you own multiple shares of a company, you’ll see larger losses or gains on your balance sheet.

If you’re an advanced investor, feel free to skip this section of the article. I’m writing this for those who are interested in investing but aren’t sure where to start or how to begin looking at the basic foundations of acquiring a company for their portfolio.

If you click on the five-year chart, you can see that the J.M. Smucker Company has returned investors 8.79% per share, or $9.77 per share, over a five-year period.

However, I want to note that once you get into the financial statements, you might see that the company has returned more than what has been stated. For example, dividends aren’t always accounted for in returns.

Before I write about this I want you to remember that past performance does not guarantee future results, so even if a company did well, over a 20 year period, it doesn’t mean it will continue to do well over the next 10-20 year period.

Clicking on the max chart, which goes back as far as when the company IPO’d—meaning when it first became public for investors to acquire shares through the stock exchange—you’ll see that the all-time returns have been 394.36%, or $96.50 per share.

Which means depending on when someone had bought into the company they have either doubled their investment or garnered a nice return. How significant depends on the price paid.

Diving into Delicious Peanut Butter Dividends: Exploring J.M. Smucker’s Dividend Performance

As of today, J.M. Smucker’s quarterly dividend is $1.08 per share, with an annual dividend yield of 3.57%. This yield is above the current rate of inflation, and if the dividend continues to rise, it should help hedge against inflation moving forward.

In layman’s terms, this means that the dividend income you earn from each share should maintain its purchasing power. Keep in mind, though, that dividends have been stopped, paused, or eliminated altogether throughout investment history.

For example, during COVID-19, many companies slashed or stopped their dividends entirely to conserve cash while the economy was closed. Disney halted their dividend payouts altogether, and Shell significantly reduced theirs.

The image above is a bit hard to see, as it was challenging to capture a clear screenshot of the entire dividend history. However, if you visit J.M. Smucker’s investor relations page, you’ll find a tab for dividend history where you can view their dividend payout history

In January 2023, the dividend payout was $1.02, in January 2024 it was $1.06, and in August 2024, it is now $1.08. Scrolling through their dividend history, you’ll see that their dividends have been increasing over the years, which is a good sign that: 1) inflation will be hedged, and 2) the dividends are sustainable.

“The Company’s Board of Directors typically declares a cash dividend for SJM common shares each quarter. Dividends are generally payable on the first business day of March, June, September, and December. The record date is approximately two weeks before the payment date. The Company’s dividend disbursement agent is Computershare Investor Services LLC.”

You’ll find this at the top of the dividend history page. What this means is that moving forward, unless the dividend is increased or decreased, investors can now expect $1.08 per share owned in the months of March, June, September, and December.

So for some fun calculations, someone who owns 1,000 shares of J.M. Smucker will be paid $4,320 yearly, which means every March, June, September, and December they will receive $1,080 to their chosen account.

Someone who owns five shares would receive $21.60 per year, which breaks down to $5.40 in each of those respective months. This is what is fun about dividends: over time, as someone accumulates more shares, their dividends eventually help buy more shares on their own, and the compounding effect takes off over time.

Diving into Delicious Peanut Butter Savings : Exploring Savings With Peanut Butter Sandwiches

As I began to eat a bit more peanut butter to cut back on grocery costs, I find it something to smile about that not only am I saving with peanut butter sandwiches from time to time, but I’m also accumulating shares of companies that produce such items as peanut butter with these savings.

These shares then pay out dividends to my household, which will, over time, increase my grocery budget in the future. It all comes full circle. Cut back a little now in order to increase your future income through capital.

I don’t expect you to eat peanut butter sandwiches for breakfast, lunch, and dinner, but having them accessible for times when you don’t want to cook or are hungry late at night can be a lifesaver. (Unless you’re allergic) This way, excess money isn’t being spent on takeout.

With that said, the time of writing about the J.M. Smucker Company and peanut butter sandwiches has come to an end. I hope you had as much fun reading this post as I did writing it. I might even go as far as to say this has been one of my all-time favorite articles I’ve written for this site so far.

Disclaimer: This post is for informational purposes only and should not be considered investment advice. Always conduct your own research and consult with a financial advisor before making any investment decisions.

Leave a comment