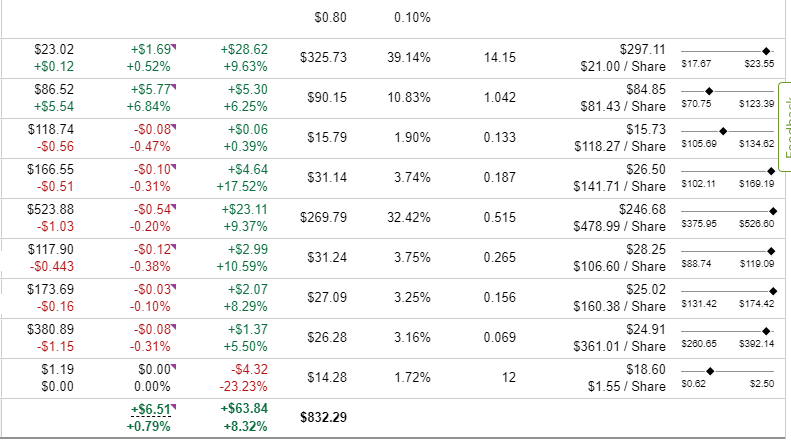

I wasn’t sure if I was going to write this update, but as you can see, the private fund is now at $830 in assets under management and should hit the target goal of $1,000 before the end of the year.

I went ahead and calculated the rest of the $5 allotment for the month and transferred it entirely since Fidelity doesn’t allow for daily automatic transfers.

This meant before the transfer I had to go in and individually transfer $5 every day. The good that came from that is it made me very aware of what was coming out of my account on a day-to-day basis and cut out all random spends that weren’t planned but could have been done if I wasn’t doing the daily $5 every day.

Fall quarter starts on Monday, which also means I have grant money coming in that allows me to put some back towards savings, which will also allow me to take some of my money on the side and put it into the investment fund, which will get it over to $1,000 by the end of this month.

I will continue the $5 daily investment strategy for the rest of the year, but it won’t be coming out on a daily basis; instead, I will multiply it by the number of days in the month and transfer the entire amount to the investment fund.

Once transferred, I will allocate funds to certain positions that I am watching and think are decently valued on the stock exchange, which again, the stock market is just for you to become a business owner of quality well-known businesses.

Since we have hit the $1,000 end-of-year goal early, I am aiming for the next milestone of $2,500 by December 2025, if not before that. It’s a conservative deadline, but with it being an election year and a lot of uncertainty, it’s best to expect that the market could either continue to hit all-time highs or take a sharp dive with all the political issues going on, including the wars overseas.

If the market turns down, it might be a good time to buy some companies at a discount, just like it was in 2020. Understand that a market can be down for years before it recovers, which means the gains you made over the last couple of years could be wiped out until the market recovers.

When this happens, the market usually recovers more than what was lost. This also depends on your holdings. Keep this in mind moving forward and do not invest what you need within the next five years. This should always be a rule, no matter how great the market is doing.

I am putting more towards savings accounts than I am towards the investment fund and household accounts.

Well, that is the update for the fund, and I look forward to celebrating the $1,000 AUM milestone next week, along with my last fall quarter of school at community college.

And as always, remember that small sums add up; it’s why I documented the fund from $0 because I want you to understand you don’t need large amounts of capital to become a business owner through the stock market.

Leave a comment