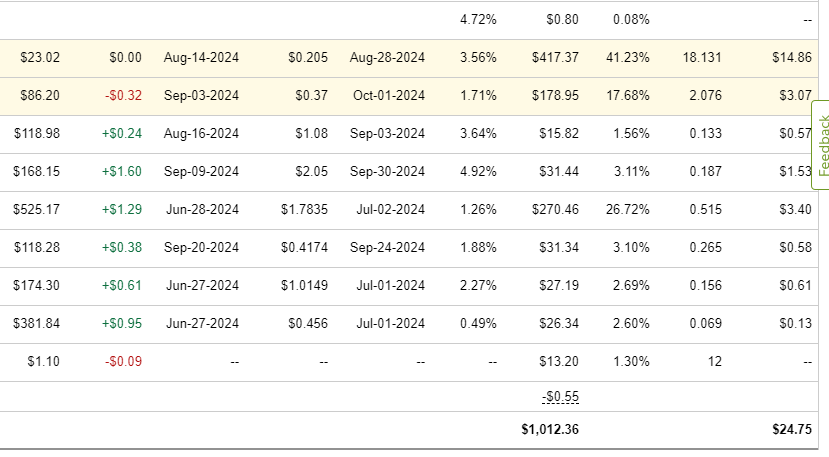

$1,000 now sits on the investment fund’s private balance sheet with an annual income of $24.75, which will turn into $26.35 either this week or sometime next month from a couple more share purchases. I am excited to announce that this milestone was hit within the deadline because it allows me to move towards the next goal of $2,500 by December 2025. As I have said before, it’s a conservative deadline but one that leaves room for market mishaps and cash flow fluctuations.

18 shares of Kenvue now sit on the balance sheet under $25 a share, which was my personal goal when acquiring them—well, 20-25 shares—but it’s close enough. With the monthly $50 that goes into the fund, I might scoop up a couple more shares to add to the position, rounding off at 20 shares with an annual dividend of $0.80 per share.

I don’t like sharing what companies the fund holds, but sometimes I write these for my documents so I can look back and see certain milestones such as this one. Nike also sits on the balance sheet with 2 shares, which is a nice addition at its current price point on the stock exchange.

Again, remember anything that I write is not investment advice and shouldn’t be taken as such. Understand that even if you invest in what Warren Buffett invests in, you can still lose money because you will never know the full scope of the investment.

For example, he can sell out without anyone knowing right away. It takes time for documents such as 13-F, which tell us which securities (stocks, bonds, etc.) have been bought and sold, to be filed with the SEC (U.S. Securities and Exchange Commission). You should assume the same for me and any other investor you follow.

When we speak about an investment, it is a minor glance at our balance sheet. If something happens and I need to sell, my first thought isn’t to warn others—it’s to protect my household assets (including the private investment fund) and do what needs to be done. This isn’t some conceived plan to be selfish; it’s more like grabbing your loved ones in a fire and running out the door. Then, when the dust settles, you suddenly remember that you forgot to grab the fire bag that has all your documentation and family pictures.

This is why you should never blindly follow another investor without doing your own due diligence. You shouldn’t expect anyone to bail you out if things go wrong. Don’t fall into the common traps of false promises from class action lawsuits that many individual investors sign onto, only to find there is no case. The SEC is there to protect investors from purposeful misleading activity from companies, but it isn’t there to protect you from willful ignorance of what you hold.

Furthermore, understand that the world of investing doesn’t have to be scary—it just requires you to be an adult and move differently than the majority if you plan on building a portfolio that provides cash-generating assets for you and your family. I have written here about how one should view the stock market through a business lens rather than as a stock picker.

Understand that when you own a share of a business, you have now added an asset to your financial portfolio. As long as you have done your own research to understand what you are holding, the odds of it being a liability decrease.

With that out of the way, I want to talk more about the fund and what I expect from it moving forward. I expect it to hit close to $1,500 by the end of this year since it surpassed the $1,000 mark. This could change, however, depending on how well the market reacts to the presidential election and the following 12 months.

Either way, I will continue to invest the primary $50 every month with the addition of the $5 daily contribution, which will be a one-time lump sum each month. So in total, $200 a month should be invested moving forward until December 31st, 2024. This also depends on household expenses and needs.

We have cut way back on food and have either lowered or eliminated other expenses to help us invest this much, but again, it depends on if all goes to plan. Understand that you should never invest what you need within five years or what you can’t afford to lose.

The household accounts have been taken care of with cash savings, and each time I have a bit of extra cash, I flow it towards savings. $1,000 is a lot for many people, and if you don’t have it in cash, you shouldn’t have it in investments outside of your retirement accounts.

Leave a comment