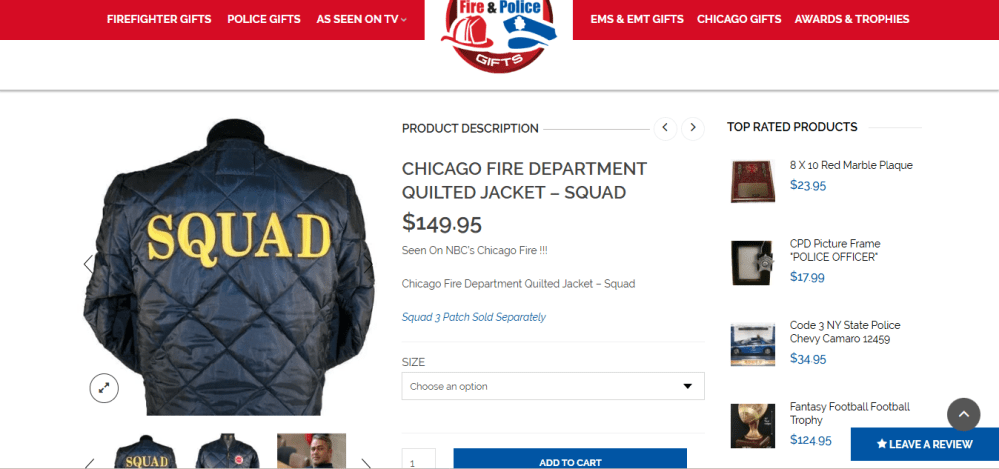

Today, after enjoying Thanksgiving food, I did some online shopping for our own version of Black Friday and Christmas shopping. I sent $15 to the emergency fund, bought a share of Kenvue for $25, sent $6 into the Nike position, $50 into our Coca-Cola position, and then spent $156.90 on the replica jacket of Squad Lieutenant Severide from the Chicago Fire TV series along with the Squad 3 patch for the teen.

He had been patient for it all year long as he had been waiting for years to get one. I finally told him for this Christmas I would get it for him if we budget and save for it, which we did. He was on it. He kept his calculator out every time we went to the store to make sure we stayed on budget. He understood the assignment.

Here is the thing, though, I am not one to shop during the holidays. I don’t like to accumulate stuff, as you might have read on the blog in the past. I don’t find much use in having more than I need. Over the years, Christmas shopping has changed into savings for our household and future cash flow for our future selves.

Christmas and Finance: How Holiday Movies Shaped My View on Money

To sum it up, Christmas to me means finance. It always has. I just didn’t return to the root of what it means to me until my late twenties. I really do owe it all to those business and Wall Street movies back in the 80s and 90s. Movies like Trading Places, Baby Boom, The Associate, Home Alone 2, and other movies like Jingle All the Way.

I remember watching the men on-screen in their business suits and briefcase in hand. White flakes usually speckled the black cloth of their overcoat from the snow outside. These movies were often filmed during the holiday season.

Does Christmas Make Me a Die-Hard Capitalist? Reflecting on the Meaning of the Holiday Season

This is probably why I cannot help but associate Christmas and finance, the two together bring me warmth in my adult years. Does this make me a die-hard capitalist? I don’t believe so, but I like to put on Christmas music while pouring over the numbers whenever I go over my account statements.

The McCallister Family: What Was Peter McCallister’s Job in Home Alone?

I always wondered about Kevin McCallister’s dad, Peter, from Home Alone and what he did for a living to afford such a big house while taking care of all those family members. I always had it in the back of my mind that he was in business and finance, and had some investments on the side. But who really knows, allegedly just from googling, my suspicions were correct, and he made his money through the stock exchange.

Investing in the Holiday Season: How I Spend Christmas Buying Shares Instead of Stuff

All these movies combined with New York and other large metropolitan cities influenced me at a young age to want to find a path to success through business and finance. Over the last couple of years, I have spent the holiday season investing in companies instead of purchasing items that will sit around long after the holiday season is over, and this has paid off dividends as I watch my portfolio grow with dividends from Hershey, Coca-Cola, Starbucks, Shell, and others.

But this wasn’t always the case. I grew up with Christmas meaning the birth of Jesus, reading the Bible before opening presents. But that didn’t last all the way through childhood. It wouldn’t be until my mid-20s when I began to grow tired of the consumption. I spent two years studying investing and the habits of successful people who had a nice portfolio and were well-to-do.

How I Started My Holiday Investment Routine: $5 a Day Into Fractional Shares

Between that and a random holiday season, I found myself right back where I started, combining Christmas and finance. For the first time, instead of buying all the traditional Christmas decorations, and spending money on things that I didn’t need, I invested $5 every day for December on top of my regular contribution.

Charles Schwab allows you to buy fractional shares of a company with a minimum of $5 for each fraction of the pie, which is great for those who don’t have much to invest upfront but would like to start their portfolio. Each day, I would choose the companies that I wrote down. Each company had to be a company that represented the holiday season and had been researched. There were a lot of repeats of Starbucks, Coca-Cola, Hershey, See’s Candies, aka Warren Buffett’s company stock.

It was the first time I felt good about how I spent the holiday season, instead of getting caught up in the consumerism of the season. I had partaken in the profits that will pay dividends down the road. And now, this holiday season, I am doing the same, stuffing cash into my savings account.

The True Meaning of Christmas: Focusing on What Matters Over Holiday Consumerism

Don’t get me wrong, when it comes to loved ones, I am generous and open-minded about the things they might need or want. But for the most part, between my love for minimalism and knowing what I want for my future, there is nothing I want for myself that could fit under a tree.

All this said, I often encourage others to think about their spending and if it is out of traditional habit more than a personal want. Groupthink, FOMO (fear of missing out) are real during this time. But when we think about how much we spend on items that end up collecting dust, it becomes apparent how much we could have put back for the things we actually want.

From Ronald Read to the McCallisters: Lessons on Frugality and Financial Prosperity

Seeing Peter McCallister and all these businessmen being able to afford things for their families while living in nice homes made me realize that to get to that level of financial prosperity, I was going to have to shift mindsets. I read about frugality and how ordinary, everyday people will sometimes die with millions in their accounts, catching the attention of the news.

Take Ronald Read, a janitor who everyone thought was impoverished until news broke that he donated millions upon his death. These stories are not rare and have been known to those who read and study finance and switch their mindsets. Not to say this is easy for any and all to achieve, but some will be surprised just by how much can be saved and invested when the right opportunities present themselves.

With that said, I hope you had a Happy Thanksgiving, and have a very Happy Holiday season.

Leave a comment