I sent $50 at the beginning of the month into our $KO position, which now has 43 shares, accumulating one additional share each year through dividend reinvestment. This has been the most rewarding position to date, extending beyond financial benefit.

As I’ve mentioned numerous times on this site, Coca-Cola was the first company we invested in when we got serious about investing. It continues to pay out dividends beyond financial cost-benefit analysis. In fact, it’s been so impactful that I’m working on an idea for 2025—a series.

It’s still early, but I think this project could be incredibly fruitful—not just for our wallets but for others, too. I’m in the process of recovering from the fall quarter and getting over a cold, so the concept is still in its infancy. While I’d love to dive into the meat and bones of the project, my body has been reminding me to take it easy.

This cycle of pushing myself until my body forces me to rest is one I know too well. Right now, I’m still a bit fatigued as I write this. However, I think this time it’s a blessing in disguise. I was pushing to get the first proof of concept out by the end of winter break, but seeing that I want this to become a long-term series, it’s better not to rush.

I can adjust and find ways to make it work alongside my upcoming winter quarter classes. With only two classes, it shouldn’t be too overwhelming.

Now, if you came here to read about the 43 shares of Coca-Cola sitting in my account, let me share the details with you.

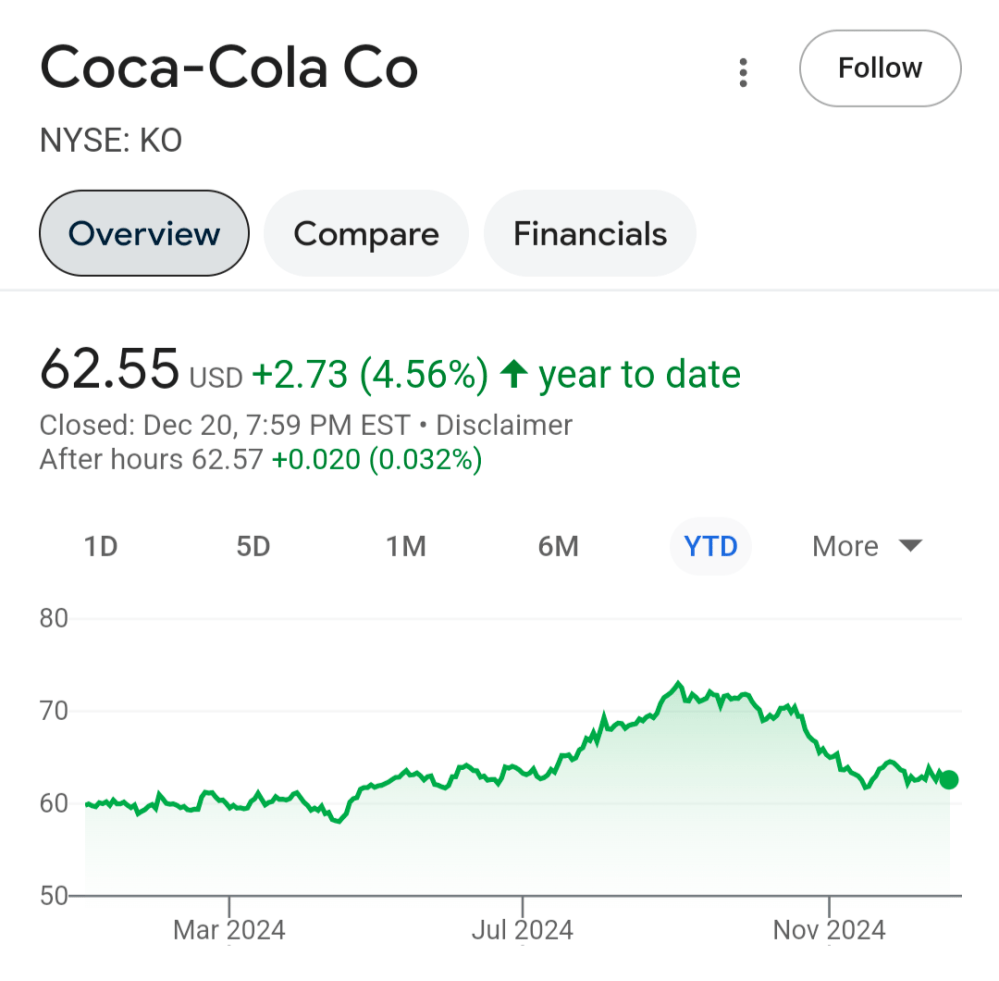

As of right now, Coca-Cola (ticker symbol: KO) is $62.55 per share.

Year to date, Coca-Cola shares have grown by 4.56% or $2.73 per share. For those new to investing, this means that for each share we’ve held since January 2024, the value of each share has increased by $2.73.

Shares accumulated after January 2024 benefited from some of this growth, but the amount depends on when they were acquired and at what cost. For example, a share purchased in July wouldn’t have gained the full $2.73 since it wasn’t in the market for the entire year and a share purchased above the current market price wouldn’t see a positive gain at the moment.

On December 16th, Coca-Cola cut a check and sent $20.52 to my household, which was automatically reinvested for more shares and a higher slice of income the next time a check is cut. For the year, a total of $81.21 was paid out to our household. In 2023, we received $74.67, and each time, the checks were reinvested for additional shares.

(Keep in mind, the estimated amount for 2025 doesn’t include the annual dividend raise that investors have a good chance of benefiting from.)

This position in Coca-Cola continues to grow alongside me as an investor, keeping me grounded while I learn all I can about becoming the investor I need to be for my future. It won’t make anyone rich overnight, but it has taught me the value of the long game and the beauty of the slow burn. That mindset can be applied to other areas of life—like the idea I have for 2025.

This idea involves creating a series, and maybe even another blog dedicated to it. I’ll continue to update here while keeping the details under wraps. Like the private investment fund name, I haven’t trademarked anything yet.

With that said, I hope everyone has a Merry Christmas and/or Happy Holidays!

Leave a comment