The Cost of Regret in Money Decisions

We’ve all been there—standing at the register, wondering why we just spent $200 on textbooks we might not even need, or staring at a stock chart, regretting selling too soon. The feeling is the same: I should have known better.

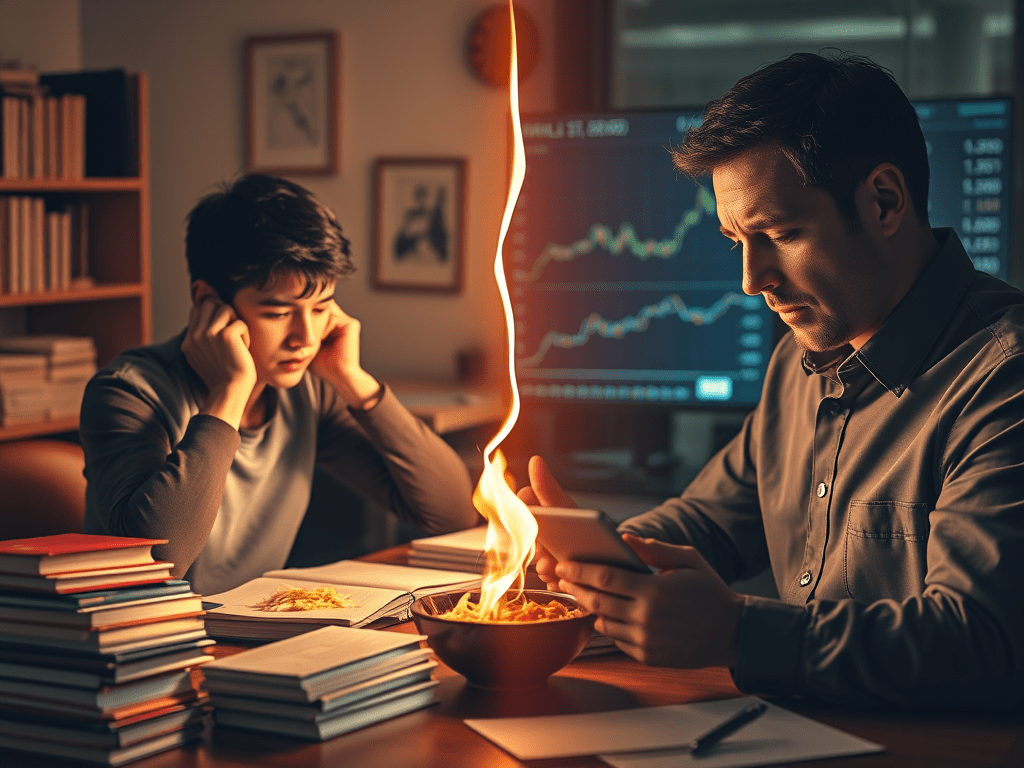

But here’s the truth—whether you’re a college student managing a tight budget or an investor navigating the stock market, regret-driven decisions can be one of your biggest financial traps.

Think about it: You get your Pell Grant money, and suddenly, spending feels easier. You convince yourself you need that expensive textbook or justify dropping $25 every weekend at that trendy ramen shop because your roommates are doing it. Before you know it, your financial aid disappears, and you’re left struggling for the rest of the semester.

In investing, the same thing happens. People panic sell when stocks dip, FOMO-buy hype stocks, or make impulse trades just to feel in control. The problem isn’t just the mistake—it’s how regret leads to even worse decisions.

In this article, we’ll break down:

- The science of regret and loss aversion (why your brain works against you).

- The unexpected parallels between college money mistakes and investing regrets.

- The most common mistakes driven by regret—and how to avoid them.

Let’s dive in.

The Science of Regret & Loss Aversion

Why We Fear Losses More Than We Value Gains

Regret isn’t just an emotion—it’s a built-in survival mechanism. Psychologists call it loss aversion, which means we feel the pain of losing twice as intensely as the joy of winning.

Imagine these two scenarios:

- You find $20 on the ground—great, right? You feel a quick rush of happiness.

- You lose $20 from your wallet. That feeling? It lingers longer, eats at you, and might even affect the rest of your day.

The brain treats losses like danger signals—back in the day, making the wrong decision could mean starving or getting eaten by a predator. Fast-forward to today, and our brains still react the same way—but now, the “predator” is a bad financial decision.

How This Affects Investors & College Students Alike

- Investors: Sell stocks too soon because they fear losses. They’d rather take a small guaranteed win than risk losing more.

- College Students: Panic over money and spend impulsively. They might blow through grant money, thinking it’s better to use it now before it’s gone.

The Problem? It Leads to Short-Term Thinking

Loss aversion makes both groups focus on avoiding regret in the moment, instead of making smart long-term decisions. Investors panic sell during a dip. Students waste money on things that feel essential at the time (expensive books, overpriced coffee, dorm snacks) but don’t actually matter.

Lots of students can relate to this even further down the road when FOMO kicks in. You have a couple of roommates on campus who love splurging on weekends, and no one’s thinking about the loan money or grant money. They’re just thinking, Hey, you want to go to that new ramen shop down the street? Every weekend, you drop $20 on ramen and tip $5. Before you know it, that habit has eaten up a huge chunk of your Pell Grant or loan money.

You also see it in trends—at one point, electric boards were the “must-have” on campus. People justified spending hundreds of dollars because everyone else had one. The problem? Most students aren’t considering the reality that a huge percentage of their classmates are on financial aid, scholarships, or loans. But because money is being spent around them, it feels normal to spend too.

The Parallels Between Investors & College Students

At first glance, investors and college students don’t seem to have much in common. But when it comes to how they handle money and regret-driven decisions, the similarities are eerie.

1. Impulse Decisions Feel Smart in the Moment

- Investors: See a stock rising and panic-buy at the top (I don’t want to miss out!)—only for it to crash right after.

- College Students: See their friends getting the latest gadget, trend, or experience and spend Pell Grant money on it (I’ll figure it out later!).

Example: The rise of electric boards on campus. Everyone had one, so students justified the purchase, even when they were broke and on financial aid. Investors do the same thing when a stock is hyped up (GameStop, anyone?).

2. Selling or Spending Too Soon Out of Fear

- Investors: Sell stocks the moment they see a small profit because they fear it might drop.

- College Students: Spend money fast because they fear not having it later (or because they see their friends spending).

Example: Getting Pell Grant money at the start of the semester and blowing a chunk of it on things like eating out, new clothes, or dorm gadgets—then struggling to afford essentials by midterms. Investors do the same thing with profit-taking, cashing out early when they should have let their investments grow.

3. The Long-Term Cost of Short-Term Thinking

- Investors: Cash out too soon or trade too frequently, missing out on long-term gains.

- College Students: Don’t budget or save, leading to credit card debt and financial stress later.

Example: A student who spends recklessly ends up relying on credit cards to survive the second half of the semester. In investing, this is like a trader who jumps in and out of stocks, losing more in fees and missed growth than if they had just stayed invested.

Common Money Mistakes Driven by Regret & FOMO

1. Emotional Spending: Retail Therapy vs. Panic Buying

- Investors: See a stock crash and panic-buy to “catch the dip” without research.

- College Students: Feel stressed about exams or life and impulse buy things like clothes, gaming consoles, or random Amazon purchases.

Example: That moment after bombing an exam where suddenly, buying a $120 hoodie feels like self-care. Investors do the same when the market drops—they throw money at stocks out of emotion rather than logic.

2. Short-Term Thinking: YOLO Spending vs. Day Trading

- Investors: Trade too frequently, chasing short-term wins instead of long-term gains.

- College Students: Blow their loan or grant money in the first month, thinking they’ll “figure it out later.”

3. Fear of Missing Out (FOMO): The Trend Trap

- Investors: See a stock trending on Reddit or Twitter and jump in too late.

- College Students: See their friends buying electric boards, fancy headphones, or new tech and feel pressured to keep up.

4. The Sunk Cost Fallacy: Holding Onto a Bad Decision

- Investors: Refuse to sell a failing stock because they’ve already lost too much and don’t want to admit a mistake.

- College Students: Stick with a useless $200 textbook they never needed, just because they already paid for it.

How to Overcome Regret-Based Financial Decisions

Regret can either teach you a lesson or trap you in a cycle of bad decisions. The key is recognizing it before it controls your financial future. Here’s how both investors and college students can stop making regret-driven money mistakes:

- Reframe your losses—learn, don’t linger.

- Use the 24-hour rule to curb emotional spending.

- Automate good financial habits.

- Stop comparing yourself to others.

- Save where you can even if it’s a little.

Final Thoughts

Regret can set you up to learn from the mistakes you make, making you a better student and a better investor. If you master this now, you’re setting yourself up for a financial life of comfort outside of college.

Leave a comment