What is the Illusion of Control?

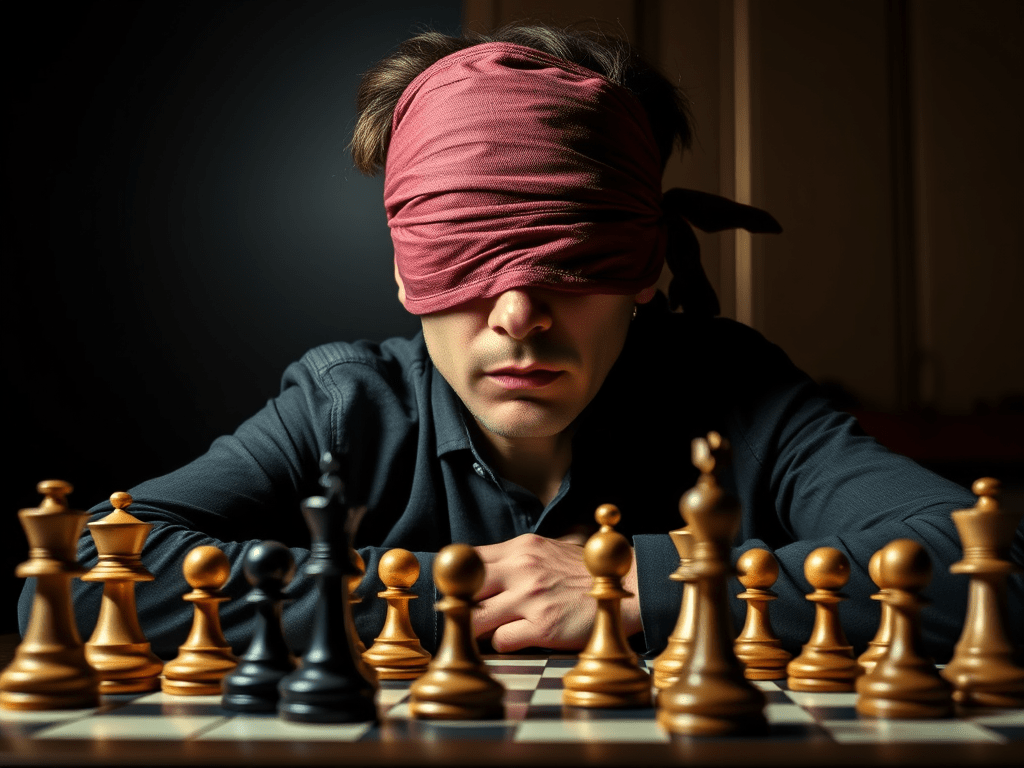

Investing is a game of strategy and decision-making, but often, it’s a game where luck plays a much bigger role than most would like to admit. The idea that we can control our investments, predict the market, pick winning stocks, and time the perfect buys and sells, can be enticing. But here’s the reality: the illusion of control is one of the most dangerous traps in investing. The truth is, the market doesn’t bend to individual will, and what you think is in your control may actually be outside your reach.

The illusion of control is the psychological bias that makes us believe we can influence events that are largely out of our hands. In investing, it shows up when we think that by researching the right stocks or making the right predictions, we can somehow outsmart the market. The reality? The market is unpredictable. It’s a complex system shaped by countless variables, many of which are outside any single investor’s control. Yet, time and time again, we convince ourselves that by getting the right information, we can make the right moves and beat the system.

How It Manifests in Investing

- Overtrading: Investors often believe they can time the market, buying and selling frequently in hopes of capitalizing on short-term movements. However, overtrading is a clear sign of the illusion of control. In truth, trying to time the market consistently is nearly impossible. The most successful investors know that it’s not about making daily predictions, it’s about a long-term strategy and staying the course.

- Stock Picking Bias: The belief that you can pick individual winners is another manifestation of the illusion of control. People often fall into the trap of thinking that they know a company’s future better than the market. But stock prices are influenced by a multitude of factors, many of which are impossible to foresee. Even the most experienced investors can’t predict the future with certainty.

- Pattern Recognition & Coincidence: Humans are wired to look for patterns, even in random data. Investors can become overly confident in identifying trends where none exist. This bias, called apophenia, makes us believe that we can control outcomes by spotting what seems like an opportunity. But the market is random, and patterns can easily be mistaken for coincidence.

The Dangers of the Illusion of Control

Believing that you can control the market leads to risky behaviors. Overtrading, stock picking, and acting on false patterns often result in unnecessary losses. When you feel you have control over something as unpredictable as the market, you may ignore basic risk management principles, like diversification or setting stop-loss orders. This false confidence can also cause you to chase after high-risk investments in hopes of fast returns, ignoring the long-term strategy that actually works.

How to Regain Real Control

So, how do you regain control in a market that’s out of your hands? The answer lies in focusing on what you can actually manage.

- Focus on Controllable Factors: The key to real control is not trying to outguess the market. Instead, focus on what you can control, your asset allocation, your fees, and your risk management. A well-balanced portfolio, designed for the long-term, is more reliable than trying to time the next big trend.

- Understand Market Uncertainty: The market is unpredictable, and no one can accurately predict every movement. Accepting this reality allows you to approach investing with a clearer, calmer mindset. Real control comes from making decisions based on your goals and risk tolerance, not on short-term whims.

- Recognize Psychological Traps: The illusion of control often leads to emotional investing. When you’re driven by fear or greed, it’s easy to believe that you can act strategically in moments of panic. But emotional investing often leads to poor choices. By sticking to your long-term strategy and avoiding knee-jerk reactions, you can sidestep many common pitfalls.

Conclusion

The illusion of control is a trap that even experienced investors fall into. But it’s possible to break free by focusing on what you can truly control, your strategy, your long-term goals, and your risk management. When you accept that the market will always have its unpredictable nature, you can stop trying to force control over it. Instead, you can learn to navigate it wisely, armed with the knowledge that long-term strategy, patience, and discipline are the true keys to success.

This doesn’t mean one cannot be a buy-and-hold investor or choose to invest in individual stocks. It simply means that when you view the stock market as a game of stocks rather than a marketplace for buying shares in quality businesses with solid fundamentals, you end up relying on luck far more than necessary. By removing the lottery mindset of trying to predict wins and stock prices, you can approach investing with a clearer, more grounded strategy. Focus on the long-term value of solid investments rather than the unpredictable swings of short-term speculation. In the end, patience and research will always outperform luck and the need for ‘stock picking’.

Leave a comment