Most people think you need a lot of money to start investing. But history has shown that patience and consistency matter more than income level.

Take Ronald Read, a janitor and gas station attendant. Despite earning modest wages, he amassed an $8 million fortune by investing in individual stocks and holding them for decades. Then there’s Warren Buffett, one of the world’s richest investors, who bought his first stock at 11 years old, not with millions, but with savings from delivering newspapers.

Both men built wealth with long-term investing strategies that anyone, yes, even someone on a low income, can apply today. If you want to start investing with little money and build financial security over time, this guide will show you how.

1. How to Start Investing with Little Money (Lessons from Ronald Read & Warren Buffett)

Many beginners assume that small investments don’t make a difference. But the reality is that even tiny amounts, invested consistently, can grow into a significant portfolio over time.

A. The Power of Starting Small (Even with Pennies on the Dollar)

Ronald Read never earned a six-figure salary, yet he quietly built an $8 million portfolio by investing in blue-chip dividend stocks, companies like Wells Fargo, Procter & Gamble, and J.P. Morgan Chase, and holding them for decades.

His strategy was simple but powerful:

✅ He lived below his means – He saved instead of spending on luxuries.

✅ He invested in established companies – He focused on dividend-paying stocks that grew over time.

✅ He reinvested his dividends – This allowed his portfolio to compound over the years.

✅ He ignored market noise – He didn’t panic sell, even during recessions.

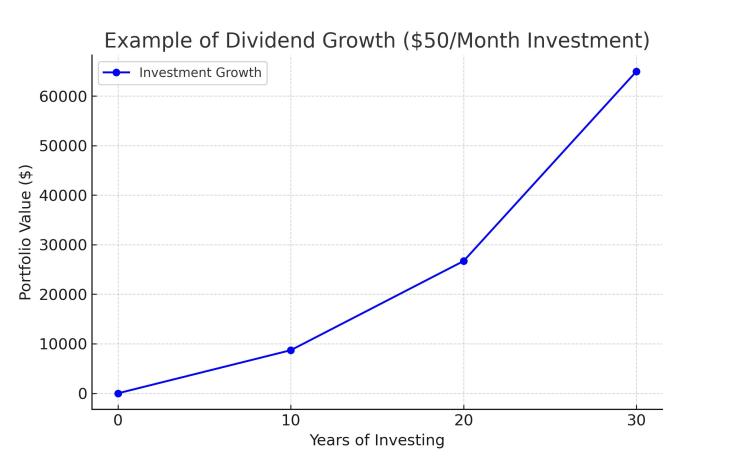

Example of Dividend Growth:

Imagine investing just $50 per month into dividend-paying stocks. If those stocks yield an average of 3% in dividends per year and grow at a 7% annual return, here’s what happens:

- After 10 years → ~$8,700

- After 20 years → ~$26,700

- After 30 years → ~$65,000

And that’s just from $50/month. If you gradually increase your investments, the growth accelerates even faster.

Here’s a graph illustrating the Example of Dividend Growth. It shows how a $50/month investment in dividend stocks can grow over 30 years with reinvested dividends.

B. How Warren Buffett’s Early Investments Hold Key Lessons for Beginners

Before Warren Buffett became a billionaire, he started small.

At age 11, he purchased three shares of Cities Service Preferred stock for $38 per share, only to watch the price drop to $27. But instead of selling out of fear, he held onto it, and it eventually climbed to $40 per share.

Even though he sold too early (a mistake he later regretted), the experience taught him:

🔹 Patience pays off – Short-term losses don’t matter if you invest in strong businesses.

🔹 Timing the market is impossible – Instead of worrying about perfect timing, just start.

🔹 Reinvesting is key – Buffett learned that compounding is what grows wealth over time.

C. Getting Started with Limited Funds: The Step-by-Step Plan

If you’re investing on a low income, here’s how to get started today:

1. Choose Your Investment Type

- If you want to follow Buffett & Read’s investing approach, start with individual dividend-paying stocks (e.g., Coca-Cola, Johnson & Johnson, or McDonald’s).

- If you prefer a lower-maintenance approach, consider an S&P 500 index fund (Buffett’s favorite recommendation for beginners).

2. Pick a Platform That Allows Small Investments

- Fidelity, Schwab, M1 Finance → Great for buying individual stocks with fractional shares.

- Vanguard, Charles Schwab, Fidelity → Best for low-cost index funds.

3. Start with Just $10, $20, or $50 per Month

- Even small amounts compound over time.

- Automate your investments so you don’t have to think about it.

4. Reinvest Dividends & Stay the Course

- Dividend reinvestment is crucial for long-term growth.

- Ignore daily stock movements, wealth is built over decades, not days.

2. How to Stay Confident in Market Crashes (Lessons from Buffett & Read)

Investing isn’t just about putting money in, it’s about staying invested when things get rough.

A. Buffett’s Golden Rule: Don’t Let Fear Control You

Warren Buffett famously said:

“Be fearful when others are greedy, and greedy when others are fearful.”

During the 2008 financial crisis, when most investors panicked and sold their stocks, Buffett bought more shares in companies like Goldman Sachs, which later rebounded and made him billions.

Lesson for Beginners:

- Market downturns are normal – The S&P 500 has dropped 20%+ many times but has always recovered.

- The worst thing you can do is panic sell – Selling at a loss locks in your losses.

- Stick to solid businesses – Companies like Apple, Microsoft, and Coca-Cola have bounced back from every crash.

B. Ronald Read’s Unshakable Patience During Recessions

Despite witnessing multiple market crashes, Read never sold out of fear. He kept investing in dividend-paying companies, knowing they would continue generating passive income.

💡 Real-life example:

During the dot-com crash (2000-2002) and the 2008 financial crisis, his portfolio took hits, but he didn’t panic. Instead, he:

✔️ Held onto strong companies that continued paying dividends.

✔️ Used downturns as buying opportunities (stocks were “on sale”).

✔️ Reinvested dividends, so when the market rebounded, his gains were even larger.

Final Thoughts: Small Investments Today = Big Wealth Tomorrow

You don’t need a six-figure salary or a fancy finance degree to build wealth. If a janitor can turn spare savings into millions, and an 11-year-old paperboy can become a billionaire, what’s stopping you?

By starting small, staying patient, and investing consistently, you can build a strong financial future, regardless of income level.

Key Takeaways:

✅ Start with what you have, even $10 or $50 a month.

✅ Invest in strong businesses or index funds for long-term growth.

✅ Ignore short-term market swings—focus on decades, not days.

✅ Reinvest dividends and let compound interest do the heavy lifting.

If Ronald Read could quietly become a millionaire through simple investing, so can you. The key is to start today.

Disclaimer: this is just an informational article. It is not investment advice. Do not invest your money into a stock until you speak to a licensed financial advisor or do your own research. Understand that no stock or business is 100% safe. There is always risk involved.

Leave a comment