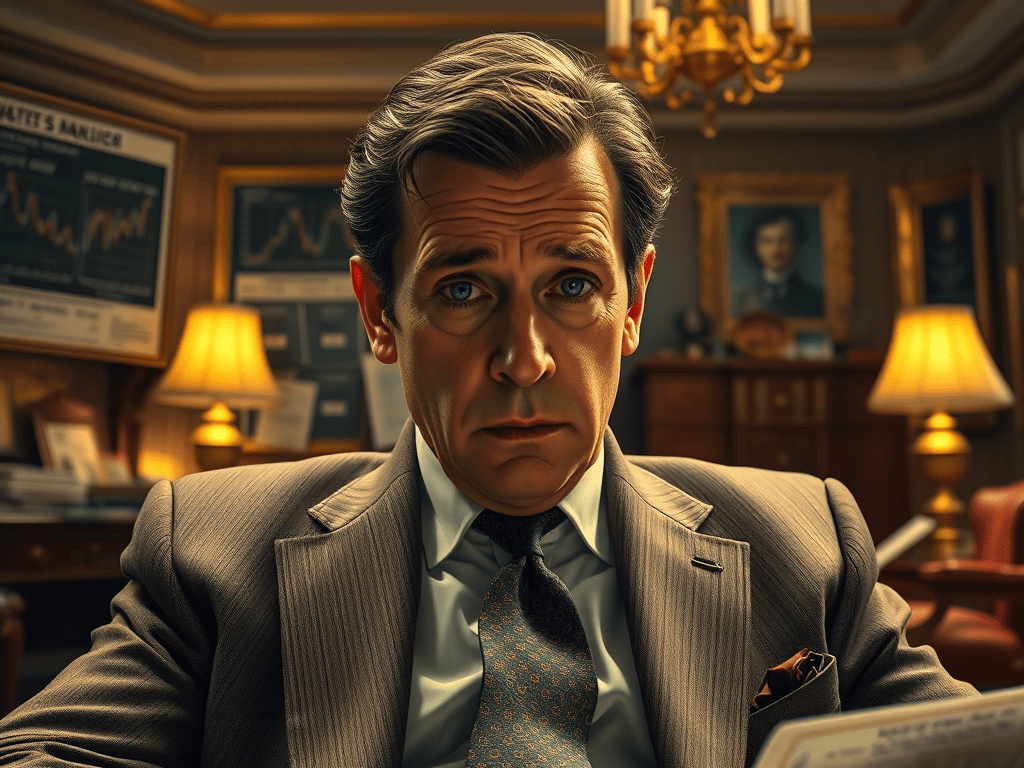

Ever wondered how fast financial fortune can change? Meet Louis Winthorpe III, the privileged and wealthy commodities broker from Trading Places, who goes from an elite lifestyle to complete financial ruin overnight, only to fight his way back.

His journey is a powerful lesson in financial resilience, the unpredictability of wealth, and how financial literacy can be a tool for both success and survival.

Louis Winthorpe III’s Journey from Wealth to Rock Bottom—and Back Again

In this article, we’ll explore the financial lessons Louis’ story offers:

- How wealth can be lost just as quickly as it’s gained

- Why financial security requires more than just income, it requires knowledge

- The importance of resilience and adapting when financial hardship strikes

- Ethical investing vs. financial exploitation, why integrity matters in wealth-building

1. The Unpredictability of Wealth: Why No One Is Immune to Financial Ruin

At the beginning of the film, Louis is a successful commodities trader at Duke & Duke, living a life of privilege with a high salary, a mansion, and a fiancée who values wealth above all else. But when his bosses, the Duke brothers, make a cruel bet to test the idea of nature vs. nurture, Louis is framed for theft, stripped of his wealth, and cast into poverty while street hustler Billy Ray Valentine takes his place.

This extreme reversal highlights a brutal truth, financial security isn’t guaranteed, even for those who appear to have it all.

What We Can Learn:

Louis’ downfall teaches us that job titles and salaries don’t equal long-term financial security. It’s easy to assume that a high income protects against financial disaster, but without proper money management and adaptability, anyone can lose everything.

To avoid this pitfall:

- Don’t rely solely on a single income stream, diversify your wealth through savings, investments, and assets.

- Avoid lifestyle inflation, living within your means, even at higher income levels, ensures financial stability during unexpected downturns.

2. Financial Knowledge Is More Valuable Than Wealth Itself

One of the most powerful lessons in Trading Places is that financial knowledge is the real asset, not just money. Even after losing everything, Louis still understands how the market works, he has the knowledge and skills to rebuild his wealth. By the end of the film, he and Billy Ray use their financial expertise to outsmart the Duke brothers, regaining control of their financial future.

What We Can Learn:

Louis’ story proves that financial literacy is the greatest tool for building and protecting wealth. Having money without financial knowledge is a fragile position, true security comes from knowing how to make, grow, and manage money effectively.

To build your financial knowledge:

- Learn the basics of investing, saving, and budgeting, a solid foundation ensures you can make smart financial decisions.

- Understand how markets work, even if you’re not a trader, knowing how economic trends affect personal finance helps you make informed investment choices.

3. Resilience and Adaptability: Overcoming Financial Hardship

At his lowest point, Louis struggles with the reality of his new financial situation. He experiences despair, depression, and even contemplates drastic measures. But when he eventually teams up with Billy Ray, he starts to fight back, showing us the power of resilience and adaptability when facing financial hardship.

What We Can Learn:

Financial hardship is something that can happen to anyone, but your response determines how quickly you recover. Instead of dwelling on what was lost, focusing on what can be rebuilt is key.

To apply this in real life:

- Build an emergency fund so financial setbacks don’t leave you completely stranded.

- Stay adaptable, learning new skills or exploring new income sources can help you recover from financial losses.

4. Ethical Investing vs. Financial Exploitation: Why Integrity Matters

At its core, Trading Places exposes the morally bankrupt practices of Wall Street elites. The Duke brothers manipulate the market for personal gain, highlighting the ethical dilemmas in finance. Louis initially benefits from this corrupt system, but after experiencing firsthand what it’s like to be exploited, he changes his perspective.

By the end of the movie, Louis and Billy Ray don’t just reclaim their wealth, they take a stand against unethical practices, ensuring that the Duke brothers face the consequences of their actions.

What We Can Learn:

Louis’ transformation teaches us that how you build wealth is just as important as building wealth itself. Ethical investing, financial transparency, and integrity are key to sustained financial success.

To invest responsibly:

- Avoid shady financial shortcuts, wealth built on manipulation or unethical practices rarely lasts.

- Focus on long-term, ethical investing, invest in companies and ventures that align with your values.

Conclusion: True Wealth Comes from Knowledge, Integrity, and Resilience

Louis Winthorpe III’s journey in Trading Places is more than just a cautionary tale about wealth and power, it’s a lesson in financial resilience, ethical investing, and the importance of financial literacy. His story shows us that while money can be taken away, the skills and knowledge to rebuild wealth are far more valuable.

Take Action:

- Invest in financial education—knowledge is the best defense against financial instability.

- Be prepared for financial downturns—having an emergency fund and multiple income sources can protect you.

- Make ethical financial choices—build wealth with integrity and long-term success in mind.

- Develop resilience—don’t let financial setbacks define you; learn, adapt, and rebuild.

Leave a comment