Ever wondered why the government spends money on big projects like building roads, or why they raise taxes sometimes? The answer lies in fiscal policy, how governments use their money and taxes to keep the economy running smoothly.

Fiscal policy might sound complicated, but it affects everything from your paycheck to the price of goods and services. It’s the government’s way of making sure the economy is neither overheating (inflation) nor slowing down too much (recession).

In this article, we’ll break down:

- What fiscal policy is and why it exists

- The tools governments use to manage the economy

- Real-world examples of fiscal policy in action

- The pros and cons of fiscal policy

Let’s dive in.

What is Fiscal Policy? (Breaking It Down Like You’re 5)

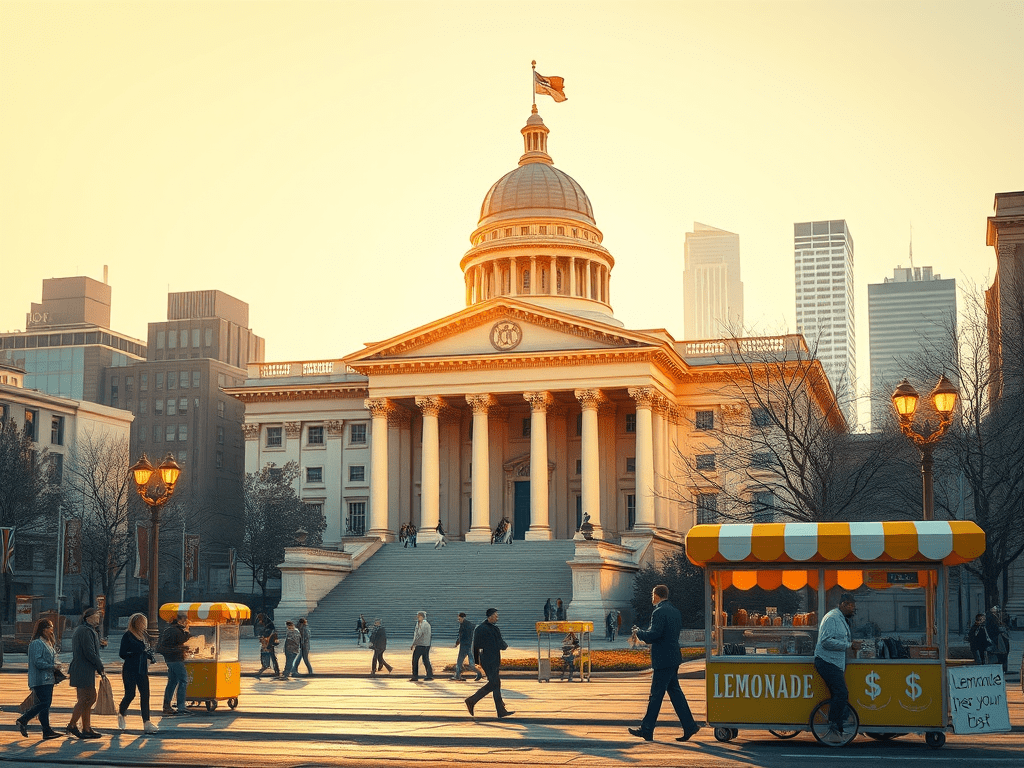

Imagine you’re running a lemonade stand in the middle of a hot summer day. When it’s super busy, you might increase the price because more people are buying, but when it’s a rainy day and no one is buying, you might lower the price or offer a discount to get customers back.

The economy is like that lemonade stand. Sometimes it’s going really well (lots of people buying things), and other times it slows down (people don’t have enough money to spend). Fiscal policy is how the government plays with taxes (how much they charge you to buy stuff) and spending (how much they spend on things like schools, roads, and hospitals) to keep the economy running smoothly.

Just like adjusting the price at your lemonade stand, the government can either increase spending or taxes to speed things up or slow things down.

Key Points

- The Goals of Fiscal Policy

- Stimulate Economic Growth: When the economy is slowing down, the government may increase spending to boost demand and create jobs.

- Control Inflation: When inflation is too high, the government may cut spending or raise taxes to cool things off.

- Reduce Unemployment: Government spending on infrastructure projects or social programs can create jobs and reduce unemployment.

- Tools of Fiscal Policy

- Government Spending: The government can spend money on projects like building roads, schools, and hospitals, or providing social services.

- Taxes: The government can raise or lower taxes to influence how much money people and businesses have to spend. When taxes are low, people have more money to spend. When taxes are high, they spend less.

How Fiscal Policy Works (And How It Affects You)

Now think of the government as the manager of a big theme park. Sometimes, the park (the economy) gets too crowded, and the rides (businesses) can’t keep up, or there are too few people coming, making things feel slow and empty. The government uses fiscal policy to control the number of people in the park and how much money is spent, keeping the fun going.

- Example of Increased Government Spending: During a recession, the government might decide to build new bridges, fund healthcare programs, or give money to businesses. This puts money directly into the economy, creates jobs, and helps people buy more goods and services, which in turn helps businesses grow. Think of it like the park manager deciding to open more rides and lower the cost to get people to come in and spend money.

- Example of Raising Taxes: If inflation is high and the economy is overheating, the government may raise taxes. Higher taxes mean people have less money to spend, which slows down the economy and keeps prices from rising too fast. This is like the park manager raising the price of tickets to keep the number of visitors at a reasonable level.

Real-World Examples of Fiscal Policy in Action

Let’s take a look at how governments have used fiscal policy throughout history to influence the economy:

- The New Deal (1930s): During the Great Depression, President Franklin D. Roosevelt used fiscal policy to try to revive the economy by spending on public works projects like the construction of roads, bridges, and schools. This government spending created jobs, put money into the hands of consumers, and helped kick-start the economy during one of the darkest periods in U.S. history.

- The Reagan Tax Cuts (1980s): In the 1980s, President Ronald Reagan lowered taxes to encourage businesses to invest and grow. The idea was that if people and businesses had more money to spend, the economy would grow. This type of fiscal policy is called supply-side economics, where the goal is to stimulate the economy by letting people keep more of their income.

- The Great Recession Stimulus (2008-2009): In response to the global financial crisis, the U.S. government passed a massive stimulus package to help revive the economy. This included tax cuts, direct financial assistance to individuals, and large-scale government spending on infrastructure projects. The government spent billions to jump-start the economy and prevent a deeper recession.

- COVID-19 Stimulus Packages (2020): During the COVID-19 pandemic, the U.S. government passed stimulus bills that sent checks directly to people, expanded unemployment benefits, and provided support for businesses. This fiscal policy aimed to keep the economy going during lockdowns, help people make ends meet, and support businesses struggling to stay open.

The Pros and Cons of Fiscal Policy

Like any tool, fiscal policy has both strengths and weaknesses.

Pros:

- Helps Fight Recessions: When the economy is shrinking, government spending can help stimulate growth, reduce unemployment, and encourage consumer spending.

- Reduces Inflation: By raising taxes or cutting spending, the government can help cool down an overheating economy and prevent prices from rising too quickly.

Cons:

- Budget Deficits: If the government spends more than it collects in taxes, it can create a budget deficit. This means borrowing money to pay for the difference, which adds to the national debt.

- Delayed Impact: Fiscal policy can take time to have an effect. For example, building roads or hospitals takes time, and by the time these projects are completed, the economy may have already changed. It’s like planning a big event and hoping it happens in time for the right season.

- Political Influence: Fiscal policy decisions are often influenced by politics. Some people might want more government spending, while others might prefer tax cuts. The back-and-forth can lead to disagreements and delays in implementation.

Conclusion

- Key Takeaways:

- Fiscal policy is how the government uses taxes and spending to influence the economy.

- When the economy is slow, the government might increase spending to stimulate growth. When inflation is high, they might raise taxes or cut spending to cool things down.

- While fiscal policy helps stabilize the economy, it also comes with challenges, such as budget deficits and delays in its impact.

Understanding fiscal policy helps you see how government decisions about spending and taxes can shape the economy and impact everything from your job to the cost of living. Whether they’re raising taxes or launching stimulus programs, the choices the government makes affect all of us.

Leave a comment