Have you ever found yourself treating a bonus at work as “extra” money, even though it’s still part of your income? Or maybe you’ve used your savings account to fund a vacation, even though that money was meant for an emergency? This is mental accounting, our tendency to treat money differently depending on where it comes from or what we intend to use it for, even though it’s all money in the end.

In this article, we’ll break down:

- What mental accounting is and why it’s a problem

- How mental accounting affects your financial decisions

- Examples of mental accounting in everyday life

- How to stop tricking yourself and make smarter money decisions

Let’s dive in.

What Is Mental Accounting? (Explaining It Like You’re 5)

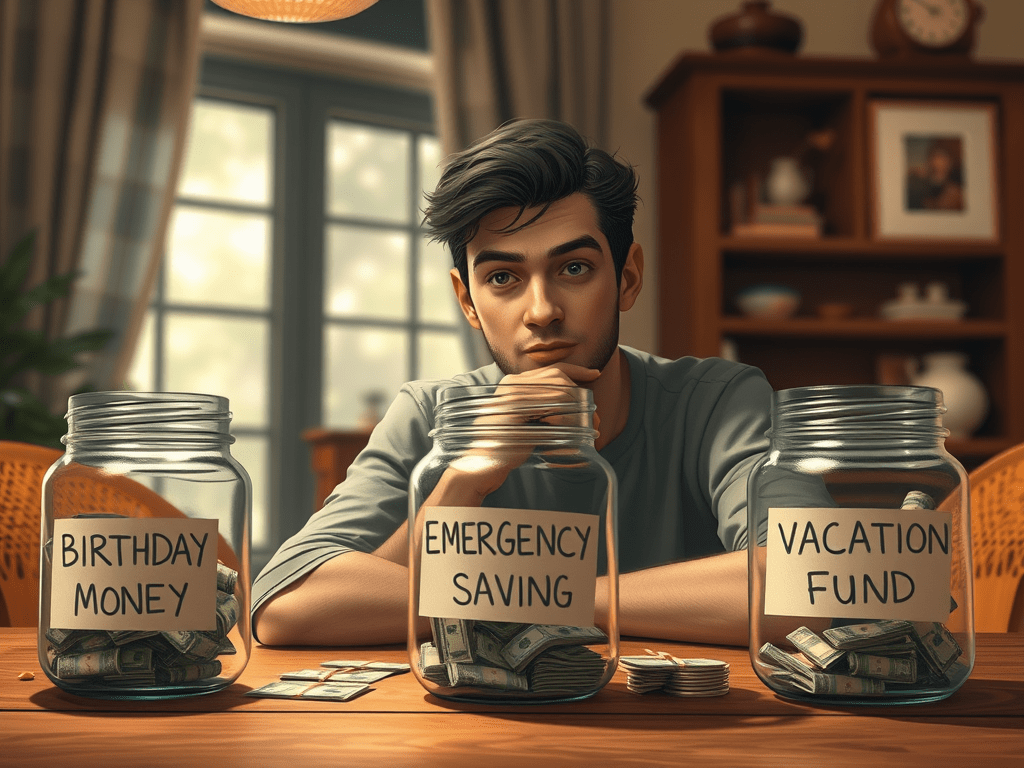

Imagine you get $100 from your grandma for your birthday, and you’re super excited. You think, “This is my birthday money; I can spend it on something fun!” But if you earned that same $100 from working at your part-time job, you might feel like it’s “work money” and need to save it for something more responsible.

Here’s the trick: It’s all money! But mental accounting makes us treat money differently depending on where it comes from or what we plan to use it for. It’s like treating your birthday money as “free money” and your work money as “hard-earned,” even though it all has the same value.

Why Mental Accounting Happens

Mental accounting is a way our brains try to simplify decision-making. Our brains don’t want to think about every dollar the same way, so we create categories or “buckets” for our money. While this can sometimes help us feel in control, it can also lead us to make irrational financial choices.

Here’s why it happens:

- Cognitive Ease: By separating money into different categories (like “vacation fund” or “emergency savings”), it feels easier to make decisions, even if those decisions aren’t always smart.

- Emotional Attachment: We often assign different emotional values to money based on where it came from. For example, we might feel like money from a tax refund should be spent on something fun, while money we earn from our job should be spent more responsibly.

- Framing Effects: How we view money can change based on the situation. The same $100 can feel different if it’s “found” money versus hard-earned money.

How Mental Accounting Affects Your Financial Decisions

While mental accounting can seem harmless, it can have negative effects on your overall financial well-being. Here’s how it can impact your money habits:

1. Spending More Than You Should on “Fun” Money

Scenario: You get a $500 bonus at work and decide to spend it on a vacation. You may tell yourself, “It’s bonus money, so it’s okay to spend it all on something fun.”

- The Issue: Your bonus is still part of your income, and spending it frivolously means you’re not treating it as responsibly as you should. You might justify this behavior because of the “bonus money” label, even though the money could be used for more essential expenses or saved for the future.

2. Not Using Savings Wisely

Scenario: You’ve set up an emergency fund, but one day you use some of that money to buy a new phone. You think, “It’s okay to dip into savings, it’s only for a phone.”

- The Issue: The money in your emergency fund is meant for true emergencies, not for non-essential purchases. By mentally categorizing it as “phone money” instead of “savings,” you’re undermining the purpose of your emergency fund.

3. Treating Credit Card Money Differently

Scenario: You have a credit card with a balance of $1,000, but you also have $500 in savings. You decide to make a purchase using your credit card, thinking, “It’s okay, I’ll just pay it off later.”

- The Issue: You’re mentally categorizing your savings and credit card debt separately, which makes you feel like you don’t need to pay off your debt immediately. However, this can lead to unnecessary interest charges and missed opportunities to use savings wisely.

Real-World Examples of Mental Accounting

Here are some real-world examples where mental accounting plays out, often leading to irrational financial decisions:

1. Treating Tax Refunds as “Bonus” Money

Many people treat their tax refunds as a “windfall” and use it for a vacation, shopping spree, or another fun expense.

- Why It’s a Problem: A tax refund is just money you overpaid to the government. It’s not extra money, but by categorizing it as such, you might make a decision that doesn’t align with your financial priorities.

2. Splurging on Sales

Scenario: You see a sale on an item you’ve been eyeing, and it’s 50% off. You think, “I’m saving $50, so I’m technically making money by buying this.”

- Why It’s a Problem: The truth is, you’re still spending money, even if it’s discounted. Mental accounting tricks you into thinking that you’re getting a better deal, when in reality, you’re just spending money you didn’t necessarily need to spend.

3. Restaurant “Treat” Spending

People often budget for dining out as a “treat,” allowing them to spend more than they normally would on eating out.

- Why It’s a Problem: The money you spend at a restaurant is still money that could be used for other priorities. Treating it as “bonus” money makes it easier to overspend without realizing the long-term impact on your budget.

How to Stop Tricking Yourself and Make Smarter Money Decisions

The good news is, you can take control of your mental accounting and stop making these irrational decisions. Here are some tips to help you get on track:

1. Treat All Money Equally

Stop mentally labeling your money as “fun money” or “savings.” It’s all just money, and each dollar should be treated responsibly. If you treat your money as a whole, you’ll make smarter decisions about how to spend or save it.

2. Reevaluate Your Budgeting System

Instead of having a “vacation fund” and “emergency savings,” try creating one general savings account for all your future needs. This will help you think about your financial goals more holistically.

3. Make Savings Automatic

To prevent the temptation to treat your savings or emergency fund differently, set up automatic transfers to savings or investment accounts. By automating your savings, you’ll make it easier to prioritize long-term goals over short-term temptations.

Conclusion: Stop Trickling Away Your Money

Mental accounting can cause you to treat money irrationally, leading to poor financial decisions and missed opportunities to improve your financial health. By recognizing mental accounting in your own life and taking steps to treat all money equally, you can make smarter, more informed financial choices.

Key Takeaways:

- Mental accounting is the tendency to treat money differently depending on where it comes from or what it’s for.

- It leads to irrational decisions, like overspending on “fun” money and using savings for non-emergencies.

- Treating all money equally and reevaluating your budgeting system can help you make smarter financial decisions.

If you want to explore how biases affect financial decisions, check out our article on Anchoring Bias 101: Why Your First Price Point Can Skew Your Decisions. We break down how your initial impressions can influence your spending behavior and how to make more objective decisions.

Leave a comment