Ever wondered what it would take to break out of the cycle of financial uncertainty and build a better life for yourself and your loved ones? The Pursuit of Happyness gives us a deep dive into the emotional, psychological, and financial struggles one man faces as he desperately works toward financial stability. This story isn’t just about money, it’s about hope, perseverance, and the human desire to overcome obstacles.

In this article, we’ll break down:

- The emotional and psychological toll of financial instability

- How perseverance and hard work can lead to financial stability

- The connection between financial security and mental resilience

- The power of hope and belief in oneself

- Lessons on economic mobility, opportunity, and determination

Let’s dive in.

The Emotional and Psychological Toll of Financial Instability (Breaking It Down Like You’re 5)

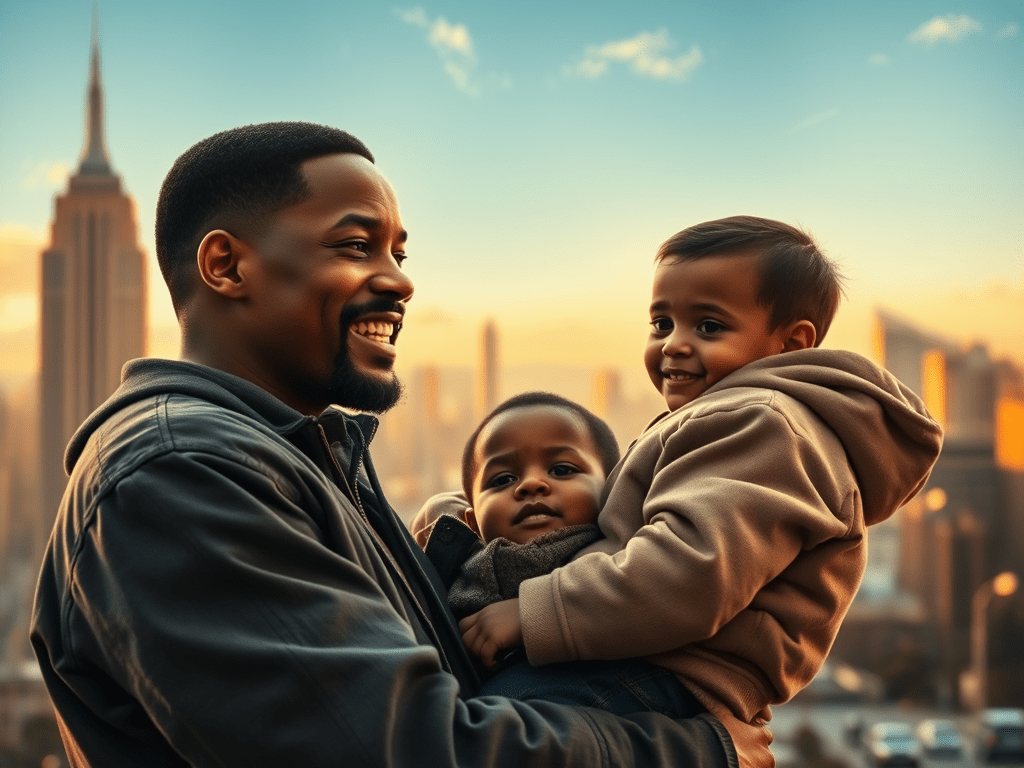

Chris Gardner (played by Will Smith) struggles with a lack of money, a broken marriage, and a challenging living situation, all while trying to take care of his young son. His battle to secure a stable future is a stark reminder that financial instability isn’t just about missing bills or not having enough to eat, it’s a constant mental and emotional burden.

Analogy: The Constant Anxiety of Financial Worry

Imagine having to wake up every day, not knowing if you’ll have enough money for rent, or if your next paycheck will cover your expenses. This constant worry affects your mental well-being, and over time, it can lead to anxiety and stress. Chris Gardner’s story shows us how living paycheck to paycheck can weigh on a person’s emotional state, pushing them to the brink of despair while also inspiring them to find a way out.

In behavioral psychology, this is linked to financial anxiety, the psychological strain that comes with the fear of financial insecurity. It impacts decision-making, often leading people to make short-term choices that aren’t in their best long-term interest. Chris’s mental battle is a powerful representation of this universal struggle.

Perseverance and Hard Work: The Path to Financial Stability

One of the most impactful themes in The Pursuit of Happyness is the idea that perseverance, even in the face of insurmountable obstacles, is crucial to overcoming financial hardship. Chris Gardner’s relentless work ethic, despite his circumstances, teaches us a valuable lesson in the importance of not giving up.

Analogy: Building a House One Brick at a Time

Think of building a house. It might seem impossible to finish it when you only have a few bricks at a time. But slowly, brick by brick, the foundation gets built. Chris shows us that financial success isn’t about getting everything at once, it’s about building the future step by step, no matter how long it takes.

This is a concept closely tied to delayed gratification and long-term planning, both of which are crucial in personal finance. While it can be tempting to make quick financial gains, long-term stability comes from staying committed, making sacrifices today, and staying focused on the bigger picture.

The Power of Hope and Belief in Oneself

Chris Gardner doesn’t give up on his dreams because he believes that his situation isn’t permanent, and that through hard work and determination, he can achieve something better.

This is the core idea of hope theory, which suggests that people with hope are more likely to achieve their goals because they believe they can find pathways to success.

Analogy: The Lantern in a Dark Tunnel

Imagine walking through a dark tunnel with only a lantern to guide you. The lantern represents your hope, it’s not much, but it’s enough to keep you moving forward. Chris’s hope is his lantern, guiding him through his darkest moments and ultimately lighting the way toward his financial success.

In terms of behavioral finance, hope is a crucial motivator for taking risks and pursuing opportunities, even in the face of uncertainty. Without hope, individuals may give in to despair, making financial decisions based on fear rather than opportunity. In Chris’s case, his hope leads him to make decisions that improve his future, even when the present seems bleak.

Economic Mobility and Opportunity: The Role of Hard Work and Luck

In the film, Chris Gardner’s breakthrough comes when he secures an unpaid internship at a prestigious brokerage firm, ultimately leading to a career in finance. This is a prime example of economic mobility, the ability to rise above one’s financial circumstances through opportunity, hard work, and sometimes, a little bit of luck.

Analogy: A Train Journey with Limited Seats

Picture a train heading toward success, but there are only a few open seats. Every day, you fight for your spot, hoping someone will give you a chance. For Chris, the unpaid internship represents that seat on the train toward financial security. But getting there isn’t easy, it requires resilience, patience, and an unwavering belief that hard work pays off.

This concept is deeply embedded in socioeconomic theory and human capital, the idea that individuals can improve their financial position through education, skills, and networking. However, as The Pursuit of Happyness shows, this journey is often influenced by systemic factors such as access to opportunities and social networks, which can either open or close doors for individuals.

How Financial Instability Affects Decision-Making

In The Pursuit of Happyness, Chris faces countless moments of financial decision-making under extreme pressure. Whether choosing between paying for food or keeping the lights on, every choice is an emotional one. This is a stark representation of cognitive bias in finance, how emotions can distort rational decision-making.

Analogy: Choosing Between Two Desperate Options

Imagine being given two choices: one option keeps you afloat for a little while longer, but it’s not a long-term solution. The other option seems too risky, but it has the potential for a bigger payoff. Most people, when faced with these options, will make the decision that provides immediate relief, often at the cost of long-term stability. Chris, however, chooses to make the long-term investment in himself, understanding that the path to lasting financial stability requires smart, calculated risks.

This situation ties back to the concept of scarcity mindset, the idea that when resources are limited, people often focus on short-term survival rather than long-term growth. Chris’s journey shows that breaking free from this mindset and focusing on the long-term goal is key to financial success.

Conclusion: What We Can Learn from The Pursuit of Happyness

The Pursuit of Happyness isn’t just a feel-good movie about overcoming adversity, it’s a powerful lesson in the emotional and psychological journey of pursuing financial stability. From the mental and emotional toll of financial instability to the importance of perseverance, hope, and long-term planning, the movie shows that the road to financial success is paved with hard work, sacrifice, and an unwavering belief that things can get better.

Whether you’re struggling with your own finances or just seeking a bit of inspiration, Chris Gardner’s story teaches us that financial stability isn’t just about money, it’s about resilience, hope, and the courage to push forward, no matter the odds.

Leave a comment