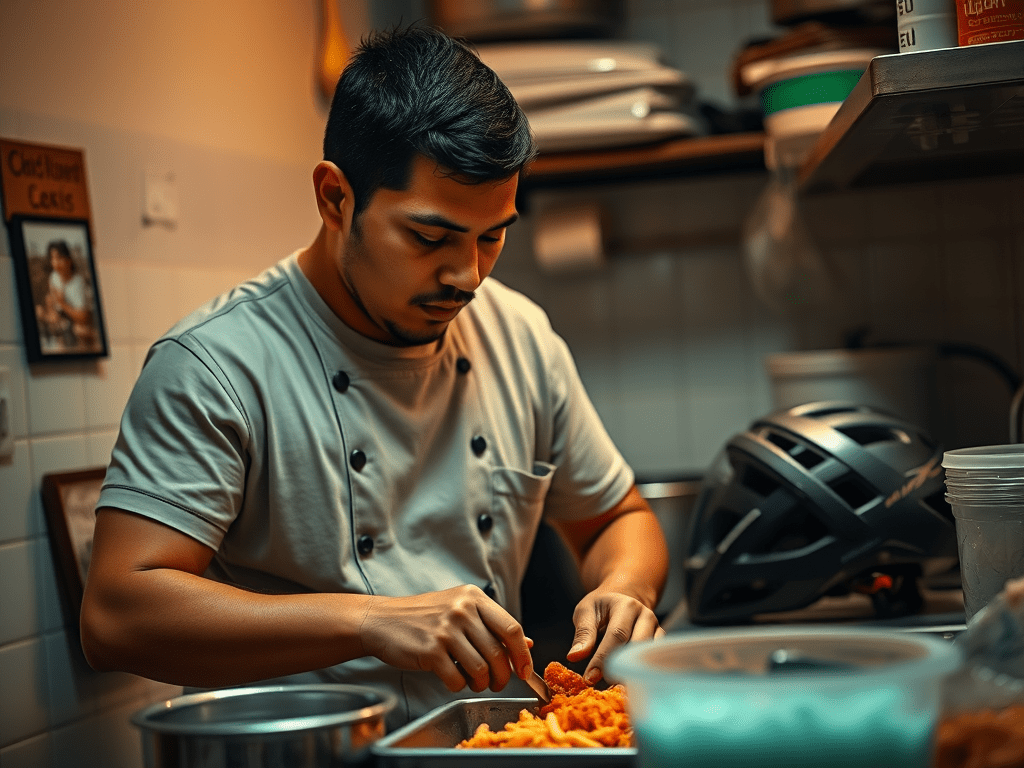

Alejandro is 24 years old. He works six days a week doing backbreaking work as a cook at two different restaurants. He doesn’t complain. In fact, Alejandro is one of those people who seems to carry the weight of his world with quiet dignity. He doesn’t have much, but he always shows up early, stays late, and sends part of his paycheck to his family in another country.

Alejandro is undocumented. He crossed the border as a teenager, alone. He left behind everything familiar in hopes of helping his younger siblings have a better shot than he did. He sends money home for school supplies, food, and sometimes even rent. When he gets a paycheck, he often only keeps about 20% for himself. The rest goes to the people who raised him.

Alejandro rents a small room in a house with five other people. The room has no closet, and the shared bathroom doesn’t always have hot water. He doesn’t own a car, so he bikes to work, rain or shine. He’s been hit by a car once and robbed another time, but both times he got up, healed, and went right back to work.

The Mental Weight of Being Undocumented

Alejandro lives with a constant sense of fear. Not just fear of deportation, but fear of being seen. He doesn’t go to the hospital unless he absolutely has to. He avoids official forms, government buildings, or anything that might require documentation he doesn’t have.

This fear shapes everything about his financial life. There’s no social security number. No credit card. No access to traditional banks. If he loses his job, there’s no unemployment check. If he gets sick, there’s no safety net.

He keeps most of his money in cash, hidden in different places. He doesn’t trust banks because he’s been turned away before. A co-worker once offered to help him open a prepaid debit account, but Alejandro didn’t feel safe giving out his name and information.

What Are Alejandro’s Strengths?

Despite all this, Alejandro has strengths that many people overlook:

- Work ethic: He works harder than most people ever will.

- Discipline: He doesn’t go out drinking, doesn’t waste money on junk, and lives well below his means.

- Loyalty: He supports his family without hesitation.

- Adaptability: He figures things out as he goes, even in a country that wasn’t designed for him.

But he also faces major challenges:

- Limited access to banking and investing tools

- No legal work status

- No path to citizenship (as of now)

- Risk of exploitation by employers

So What Can Alejandro Actually Do?

The point of this case study isn’t to offer a magical solution. There isn’t one. But there are small, real steps Alejandro and others in similar situations can take.

1. Start Building Safe, Alternative Savings Systems

Alejandro doesn’t feel safe using banks, and that’s valid. But he still needs a safe place to store money. Here are a few ideas:

- Prepaid debit cards: Some don’t require an SSN. Look for ones that are reloadable and FDIC-insured. Have a trusted friend help set one up.

- Community-based lending circles: In some immigrant communities, people form groups where each person contributes a small amount each week and takes turns receiving the full amount. It builds trust and savings.

- Cash stash with systems: If cash is the only option, create multiple hiding spots with a basic logbook (in code, if needed). Keep emergency money separate from long-term savings.

2. Invest in Low-Risk Skill Growth

Even without papers, Alejandro can invest in himself:

- Language skills: English fluency opens more stable job opportunities.

- Kitchen skills: If he’s working in restaurants, learning knife skills, food safety, or specialty cuisine can increase his pay.

- Online work: Some freelance platforms allow anonymous or limited ID work (writing, translating, logo design, etc.). Tread carefully, but explore.

Even small skills can translate to higher income over time.

3. Find Trusted Community Allies

Many nonprofits and community organizations offer:

- Free financial coaching (no ID required)

- Emergency assistance funds

- Worker rights education

Look for immigrant advocacy groups, local churches, or community centers. The key is building relationships with people who won’t report him, but who want to see him succeed.

4. Be Strategic with Income and Goals

Alejandro sends money home, and that’s admirable. But he must also create a small, protected fund for himself. It’s not selfish, it’s survival.

- Split income: Try to keep at least 10% in a personal emergency stash.

- Protect earnings: Avoid storing large sums in one place.

- Have a Plan B: Know where to go and what to do if he loses a job or needs to move fast.

Even undocumented people deserve dreams. And Alejandro may want more than just survival, he may want to open his own taco stand one day or take English classes full-time.

Without a strategy, dreams get delayed forever.

Final Thoughts

Alejandro’s story is not unusual. It’s the story of thousands of undocumented workers who quietly hold up the economy while barely being seen. They are cooks, janitors, construction workers, and caretakers. They work twice as hard for half as much, often without protection.

But even in a system that wasn’t built for them, they find ways to survive, and sometimes, to thrive.

This isn’t about pretending it’s easy. It’s not. It’s about understanding the truth of someone’s situation and working within it.

If you’re Alejandro, or someone like him, know this: You’re not alone. You’re not invisible. And you’re not powerless.

Your life deserves strategy too.

Leave a comment