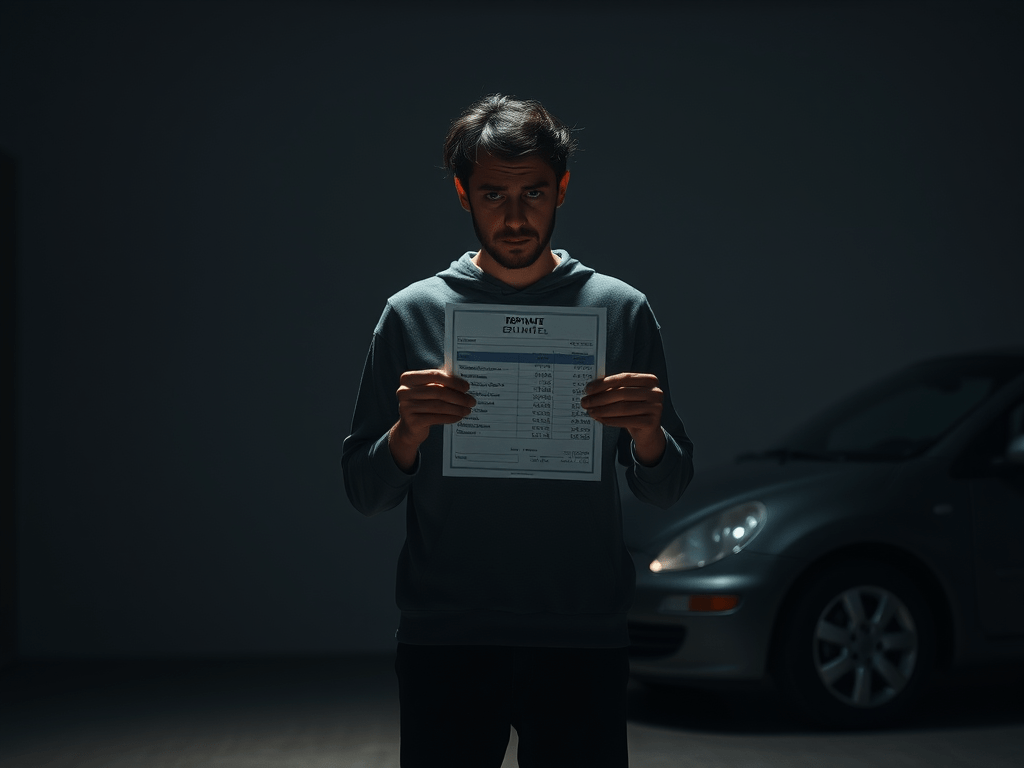

Your car breaks down. The repair is $1,200. You stare at the estimate, phone in hand, and realize there’s no one to call.

Not because you’re too proud. Not because you’re irresponsible. But because there is no one.

Financial loneliness is the feeling of being utterly alone in your money life. No co-signer. No backup. No one to spot you. No one to ask. You live within your means not because you want to, but because the fall would be too far and too quiet.

This isn’t the kind of loneliness people talk about. But it’s real. It’s heavy. And it shapes everything.

What Is Financial Loneliness?

Financial loneliness isn’t just about being broke. It’s about being unsupported.

It’s the distance between you and the nearest safety net. It’s knowing that if something went wrong, there’s no rich aunt, no reliable friend, no forgiving parent to float you the difference.

You might have friends. You might even have a partner. But when the stakes are financial, bills, emergencies, investment, recovery, you know it’s all on you.

There’s no net. There’s just you.

What It Looks Like in Real Life

You might not see financial loneliness from the outside. But you can feel it in how people move. How they carry themselves.

Here’s what it looks like in real life:

- You never ask for help, because you already know the answer.

- You overthink small purchases, not because you’re stingy, but because every dollar has to stretch.

- You turn down opportunities, trips, weddings, and job offers across the country, because one wrong move could unravel everything.

- You prepare for emergencies like they’re inevitable. Because for people like you, they kind of are.

- You stay quiet about your struggles because you don’t want pity, or worse, advice from people who’ve never had to do it alone.

And when other people joke about “just borrowing from Dad” or “getting bailed out again,” you laugh along. But the silence behind that laugh? That’s loneliness.

Why It Happens

Financial loneliness has roots. And they run deep.

1. You’re the First to Make It Out

You might be the first in your family to go to college, move out, or have a full-time job. Often, people from your background don’t go to college, and there is loneliness in that as well, the high pressure of performance while unsure of financial security. There’s pride in making it out, but again there is the external pressure. You can’t ask your family for help because they’re asking you.

2. Estrangement or Generational Poverty

Some families don’t talk. Some are struggling just as hard, or worse. You weren’t just left out of the inheritance. You were never invited to the table.

3. You Chose Survival Over Proximity

You moved away. You cut ties. You left chaos behind. But with that freedom came distance, and no one followed. Oftentimes, this also looks like cutting off old friends that you would have kept in touch with if it meant not sacrificing your potential. This can also look like cutting off friends who would give you the shirt off their back, but their proximity also threatens your future. Leaving you having to choose between a support system and a life that doesn’t threaten to harm your future in more ways than one.

4. You’re the Rock

People borrow from you. People rely on you. You’ve been the strong one for so long, no one even thinks to ask if you’re okay. When you become the one to break cycles, you become the rock for others, which means often being the bank account for them, even though this is highly controversial. For one, just because you make it out doesn’t mean you have it to help others, yet, especially in the beginning. If you’re not careful you can find yourself back at the bottom even though your life now looks different.

The Emotional Cost of Being On Your Own

Money stress is hard. But money stress alone is brutal.

Decision Fatigue

Every choice weighs more. There’s no one to double-check your thinking. Every move feels like a gamble.

Risk Aversion

You don’t take financial leaps. No entrepreneurial detours. No “it’ll work out” confidence. Because if you fall, you fall alone.

Hyper-Independence

Even when people offer help, you say no. Not because you don’t need it, but because you’ve trained yourself not to expect support. Accepting help feels foreign. Unsafe, even.

Quiet Resentment

You watch peers get help buying a home. Starting a business. Taking a break. You don’t hate them, but you ache for the version of yourself who could’ve had that, too.

The Hidden Strength in Building Alone

Let’s pause for a second. Because you need to hear this: Doing it alone doesn’t make you weak. It makes you historic. You’ve built resilience that can’t be taught. You’ve learned to budget with precision, to make $300 stretch like magic, to problem-solve under pressure. You trust your instincts. You know your limits. You’ve had to become your own advocate, strategist, and backup plan.

That kind of power doesn’t show up in net worth statements. But it matters. It matters that you kept going without cheerleaders. It matters that you survived what others were shielded from. And it matters that you’re still trying.

How to Ease the Isolation

You can’t conjure a safety net out of thin air, but you can start to build something more connected, more supported, more grounded.

Here’s how:

🧩 1. Build Financial Community

You might not have someone who can lend you $1,000, but you might find someone who can talk you through options, share what worked for them, or just listen.

Start small. Online spaces. Forums. Friends who are also rebuilding.

Money doesn’t have to be private pain.

💸 2. Save as a Promise, Not a Punishment

Emergency funds aren’t just about bills. They’re about dignity.

Save not because you’re scared, but because you deserve peace.

🧠 3. Reparent Your Financial Self

You didn’t get the money talks. You didn’t get the bailout. But you can give yourself what others didn’t.

Create rituals of care around money. Speak gently to yourself when you slip. Celebrate wins, even tiny ones.

You are worthy of softness, not just survival.

🤝 4. Practice Financial Intimacy

Start talking about money in low-stakes ways. With a friend, a therapist, a group. Not to ask for help, but to feel seen.

Let someone know you carry this. That’s a form of connection, too.

This Isn’t Just About You

Let’s name the systems.

Financial loneliness often follows systemic inequality:

- Generational poverty

- Racial wealth gaps

- Undocumented status

- LGBTQ+ estrangement

- Lack of access to inheritance, homeownership, or fair credit

You’re not failing. You were born into a world that didn’t offer you the same runway.

You didn’t have a financial parachute. You just had grit.

That’s not your shame to carry. But it is your story to reclaim.

Final Words

Some people inherit money. Some inherit options. Some inherit belief.

And some inherit nothing, but build anyway.

If you’re building a life without a safety net, I see you. You are not less than. You are not behind. You are not doing it wrong.

You’re doing something radical. You’re creating stability in a world that never handed it to you. That kind of work? That’s legacy.

You might be alone in the task. But you are not alone in the experience.

And one day, when someone asks you for a loan, or for guidance, you’ll answer from a place of lived strength. And maybe, just maybe, you’ll become the safety net you never had.

Leave a comment