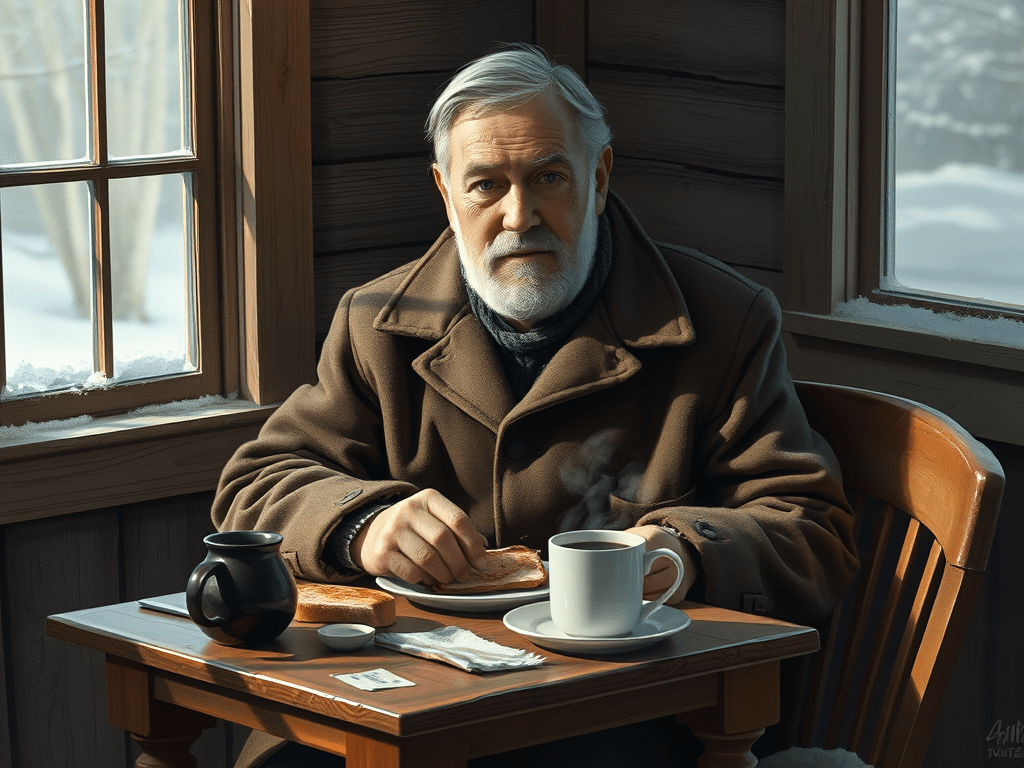

Somewhere in a quiet New England town, there’s a man who wears the same wool coat every winter, stitched twice in the elbow, never replaced. He eats the same breakfast every morning. Toast. A boiled egg. Black coffee. He walks to the bank not because he needs to, but because he likes the silence of routine. Nobody knows he’s a millionaire. He doesn’t speak about money. He just has it.

This isn’t the story of a lottery winner or a tech startup savant. This is the story of the kind of wealth that doesn’t trend. The kind of wealth you don’t see until you read between the lines, the kind passed down in silence, grown in shadows, and guarded with a discipline so quiet it’s mistaken for modesty.

We call him “the man in the mended coat,” but truthfully, there are many like him. And if you listen closely, you’ll begin to hear their language.

Wealth That Whispers

Wealth, real wealth, rarely makes a sound. It doesn’t brag. It doesn’t beg. It doesn’t show up in your feed.

It’s easy to mistake quietness for lack. But the man in the mended coat doesn’t need your attention. He buys blue-chip stocks when they’re on sale. He knows the dividend schedule of every holding. He reinvests without flinching. There’s no celebration when the market rises. No panic when it falls. He’s not here to time the waves, he owns the boat.

The language of lasting wealth is made of patience, consistency, and unsexy decisions. It lives in forgotten habits: tracking expenses, avoiding lifestyle creep, knowing what “enough” looks like, and honoring it.

The Rituals of Restraint

The man in the mended coat is a creature of habit. His rituals are so ordinary, most would overlook them. But they are the foundation of everything.

He keeps receipts. Not because he’s cheap, but because he believes in record-keeping. He reuses his tea bags, but owns long positions in Coca-Cola, Johnson & Johnson, and Procter & Gamble. His shoes are old, but his portfolio is seasoned.

He doesn’t skip pleasure. He just doesn’t lease it at 28% APR.

While others chase luxury, he collects something more powerful: autonomy. The freedom to leave a job. The freedom to say no. The freedom to live slow in a world that rewards hurry. This kind of wealth isn’t about deprivation, it’s about discretion.

The Fugitive from Noise

Every cycle brings a new wave of influencers shouting about the next big thing: crypto, AI stocks, option calls, quick flips, the “hidden secret” of wealth you can buy in four easy payments.

But the man in the mended coat does not listen.

He hasn’t watched the news in years. He reads company filings, not clickbait. While others doomscroll, he re-reads The Intelligent Investor. While others panic sell, he collects discounted shares. His watchlist isn’t guided by trends, it’s guided by temperament.

Noise is a tax on attention. And he refuses to pay it.

The Library Mind

His mind is a bookshelf.

Not literally, but conceptually. He has spent decades studying markets, history, human behavior. His investment decisions are shaped by stories, not hype. He learns from Hetty Green, Warren Buffett, Benjamin Graham, and Peter Lynch. He’s not interested in the fantasy of fast wealth. He’s interested in the architecture of enduring wealth.

He understands that the market isn’t just math, it’s psychology. It’s history. It’s habit. The man in the mended coat is not trying to predict the future. He’s trying to own businesses that will survive it.

To him, the best investments are boring: water utilities, healthcare companies, consumer staples. Things people will always need, whether or not the market approves.

He’s not in the business of excitement. He’s in the business of reliability.

When No One Applauds

There’s no applause for living like this. No one gives you a standing ovation for skipping brunch to max out your Roth IRA.

People wonder why he doesn’t upgrade his car. Why his clothes don’t change with the seasons. Why he brings a brown-bag lunch even though he could afford steak.

What they don’t see is the paid-off house. The fat brokerage account. The trust quietly set aside for his niece. The checks he writes to local scholarships, anonymously, of course.

To build lasting wealth while looking “average” takes emotional endurance. It takes being misunderstood. It takes being underestimated.

But that’s the thing about the man in the mended coat: he doesn’t need you to understand.

The Secret Language of Wealth

There is a quiet language that runs through the wealthiest people you never notice.

It’s in the way they pause before buying something, not because they can’t afford it, but because they ask, “Do I need this?”

It’s in their ability to delay gratification, not as a punishment, but as a philosophy.

It’s in the way they view time not as something to be filled, but as something to be invested.

They understand that real wealth is not a number. It’s a behavior.

They don’t fear recessions. They prepare for them. They know the economy is not a storm to survive, but a cycle to understand. They accumulate slowly, methodically, in silence. And they never mistake visibility for value.

Why It Matters Today

We live in a world that worships the visible. Flashy lifestyles. Loud success. Overnight wins.

But the quiet path still exists.

You can still choose to build wealth the slow way. The boring way. The way that doesn’t rely on luck or virality or someone else’s approval.

You can read old books. You can make peace with delayed pleasure. You can live beneath your means, not because you’re afraid, but because you’re planning.

And maybe one day, someone will look at your life and wonder how you did it. How you managed to own so much while flaunting so little.

They’ll ask, “What’s the secret?”

And you’ll smile.

Because the secret isn’t in the coat.

It’s in the discipline that made you wear it twice.

He’s Fictional, But You Don’t Have to Be

The man in the mended coat doesn’t exist. Not exactly.

But his choices do.

They’ve been made by real people, quiet, ordinary individuals who built extraordinary wealth not through brilliance, but through behavior.

Take Ronald Read, a Vermont janitor and gas station attendant who died with an $8 million portfolio. He drove a used car, clipped coupons, and read the Wall Street Journal every morning. His investments? Simple, blue-chip dividend stocks. His lifestyle? Inconspicuous. No one guessed he was wealthy until he left behind one of the largest charitable gifts in local history.

Or Grace Groner, a secretary who bought three shares of Abbott Laboratories in 1935 and held onto them through wars, recessions, and recoveries (reinvesting dividend payments instead of spending them). By the time she passed, her $180 investment had quietly grown to $7 million.

These are not fairy tales. They are financial biographies of restraint, patience, and compounding.

You don’t need to be loud to be wealthy.

You don’t need to be born rich.

You just need to believe in enough, and stay long enough for your choices to bloom.

The man in the mended coat is fictional.

But you?

You’re not.

Leave a comment