You shut down your laptop at 8 p.m. The market’s closed, dinner’s done, you’re half-asleep on the couch, then you glance at your phone one last time and see it:

S&P 500 futures down 1.4%

The regular market is asleep, but stock futures are throwing a midnight party in the dark. Why? Who’s even trading at that hour? And why do the numbers sometimes swing harder than they do during the daylight session?

Think of the overnight futures market as Wall Street’s version of Stranger Things’ “Upside Down.”

The geography is familiar, S&P, Dow, Nasdaq, but everything moves in eerie, shadowy ways while most people sleep. Same map, different physics.

Let’s flip on the flashlight and look at the human behavior driving those spooky nighttime moves.

1. Time Zones = Emotional Relay Races

Wall Street may close at 4 p.m. Eastern, but the world doesn’t. Futures keep trading because:

| Region | Local Time When New York Sleeps | What’s Happening |

|---|---|---|

| Tokyo | Morning commute | Japanese investors react to U.S. news while you dream |

| Sydney | Workday | Australia digests Asian data, U.S. headlines |

| London | Pre-market coffee | Europe wakes up, adds its own drama |

Each region passes the “emotion baton” to the next. Bad news in New York can morph into bigger fear in Tokyo, mild relief in Sydney, and something else entirely in London. By the time U.S. traders log back in, futures have already baked in three continents of mood swings.

2. Humans Hate Uncertainty More Than Bad News

Psychologists call it ambiguity aversion. Markets show it like this:

- Known Bad News → Prices drop, then stabilize

- Foggy Rumors & Half Headlines → Prices wobble all night

Overnight trading amplifies rumors because official sources are offline. If an earnings leak hints at trouble, futures will yo-yo until the company confirms or denies. Fear of the unknown moves prices more than the actual bad news ever could.

3. Liquidity Gets Thin, and Emotions Get Loud

During regular hours, millions of shares trade every minute. After hours? Far fewer participants, which means:

- Smaller orders move prices further

- Stop-loss orders trigger faster

- Algorithms hunt for liquidity gaps

Picture shouting in an empty gym versus a packed stadium, your voice (or trade) echoes farther at night.

3.5 Earnings Season: The Overnight Domino Effect

If you’ve ever wondered why futures swing so wildly during earnings season, here’s why:

- Companies often release earnings after the market closes (4 p.m. EST)

- Futures react immediately, even before full numbers are read

- If a big player like Microsoft, Amazon, or Apple misses expectations, it doesn’t just affect tech stocks, it ripples through futures for the entire market

This domino effect happens in the dark, often before most investors have a chance to make sense of it. That’s why overnight moves during earnings week can feel more extreme: they’re driven by raw reaction, not full digestion.

4. The “Risk-Transfer” Game

Big funds often use overnight futures to off-load risk:

- Portfolio manager worries about tomorrow’s economic data.

- She sells S&P futures at 9 p.m. to hedge her long positions.

- Asian traders pick up that risk, maybe they’re bullish after local data.

- Futures swing while risk changes hands across the planet.

It’s less about predicting tomorrow and more about sleeping at night without a pit in your stomach.

5. Recency Bias Runs the Night Shift

Ever notice futures spike right after a surprise NBA championship or a sudden geopolitical headline? That’s recency bias, our brain’s habit of over-weighting the last thing we heard. Overnight, when fresh information is scarce, the latest tweet or headline looms larger and moves markets harder.

6. Algo Speed vs. Human Nerves

Algorithms don’t need eight hours of sleep. They scalp quarter-point moves 24/7. Humans, half-awake, check their phones at midnight and see red futures. They panic-sell a little. Algos notice, push a bit further, tap liquidity, move on. By morning, the damage, or rebound, is done.

7. Why Futures Sometimes “Snap Back” by the Opening Bell

Most overnight plunges never make it past the opening auction because:

- Real volume returns → Price gaps fill.

- Official statements drop → Rumors die.

- U.S. economic data hits → Actual numbers replace whispers.

What felt like the Upside Down at 3 a.m. often looks perfectly normal under daylight.

Emotional Check-In: Midnight Futures Checklist

Before you act on red futures at 2 a.m., ask yourself:

- ❓Did I change my long-term investing plan today?

- ❓Do I have all the information, or just headlines?

- ❓Would I make the same decision in daylight?

- ❓What would my calmest self do right now?

If the answer is “wait,” wait. If the answer is “sleep on it,” sleep.

You’re not falling behind by pausing. You’re just avoiding mistakes that come from reacting to shadows.

How to Keep Your Sanity When Futures Freak Out

- Remember your timeline. If you’re investing for 10 years, a 1 a.m. futures dip is background noise.

- Use alerts, not adrenaline. Set price alerts for levels that actually matter to your plan.

- Sleep on decisions. Overnight moves tempt knee-jerk trades. Evaluate with coffee and sunlight.

- Know what futures really are. They’re signals, not certainties. Get the basics in my post “Stock Futures 101.”

Final Thought: Night Markets Are Just Human Markets Without the Daylight

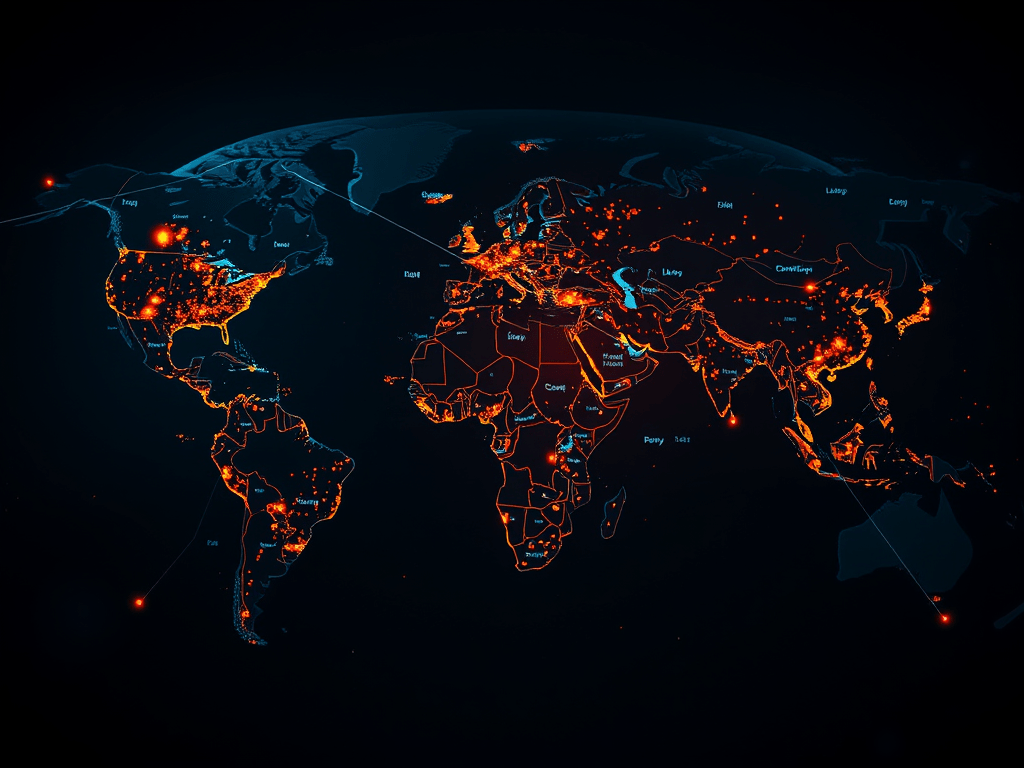

Behind every tick in the overnight futures market is a human emotion fear of missing out in Sydney, hedging anxiety in London, algorithmic opportunism in Chicago. The map is the same; the mood lighting is different.

So next time you peek at your phone at 2 a.m. and see futures flashing red, remember:

It’s just the Upside Down doing its thing. By dawn, daylight (and volume) will decide what really sticks.

Sleep tight, builder. Your long-term plan is bigger than any midnight headline.

Long-term wealth isn’t built at midnight.

But it is protected by what you choose not to do when everyone else is panicking in the dark.

This blog is read in 50+ countries (and counting). If you’re a student, teacher, or lifelong learner from anywhere in the world, I’m honored you’re here. Economics belongs to all of us

Leave a comment