Ever wonder how some investors seem to make brilliant decisions while others constantly fall short? It might not be about luck, they’re likely using mental models to guide their thinking. Charlie Munger, one of the most revered investors of our time, firmly believed in the power of mental models, and his decision-making framework helped him... Continue Reading →

Warren Buffett’s Wealth-Building Secrets: How the Time Value of Money Fueled His Success

Warren Buffett, the "Oracle of Omaha," is often seen as one of the greatest investors of all time. But how did he build such a colossal fortune? The answer lies in a combination of patience, understanding the time value of money, and making smart investments that compound over decades. In this article, we’ll break down:... Continue Reading →

The Power of Compound Interest: How Time Value of Money Can Make You Wealthy

Do you ever wonder how some people seem to accumulate wealth effortlessly while others are stuck in the same financial position for years? The answer might just lie in understanding the Time Value of Money (TVM) and the power of compound interest. Whether you're just starting out in your career, juggling school and part-time jobs,... Continue Reading →

Consumer Theory: How the Income and Substitution Effects Shape Your Everyday Choices

Why Should You Care About Consumer Theory? Ever noticed how your spending habits change when prices go up or when you start making more money? Maybe you used to get a fancy coffee every morning, but when prices went up, you switched to making coffee at home. Or maybe you got a raise and suddenly... Continue Reading →

Dynamic Pricing 101: How Your Shopping Behavior Shapes What You Pay

Ever noticed how the prices of things we want can change, seemingly out of nowhere? One minute, an item you’ve been eyeing is at full price, and the next, it’s mysteriously on sale. Well, it’s not magic, it’s dynamic pricing. Online stores and apps track your every move to adjust prices and offer discounts based... Continue Reading →

Commodities 101: What They Are, How They Work, and Why They Matter

If you’ve ever watched Trading Places, you know that commodities trading can be fast, chaotic, and incredibly profitable (or devastating). But what exactly are commodities? Why do people trade them? And how do they impact our daily lives? In the movie, Eddie Murphy’s character goes from street hustler to commodities trader, learning how the price... Continue Reading →

Anchoring Bias 101: Why Your First Price Point Can Skew Your Decisions

Have you ever walked into a store, saw a jacket marked down from $150 to $75, and thought it was a great deal, even though you didn’t need it? Or maybe you were shopping online, and you saw a high-priced item next to a lower-priced option, which made the cheaper one seem like a bargain?... Continue Reading →

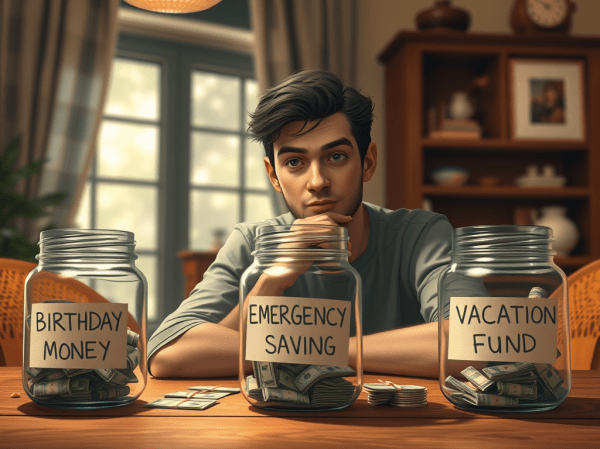

Mental Accounting 101: How We Trick Ourselves Into Bad Money Habits

Have you ever found yourself treating a bonus at work as "extra" money, even though it’s still part of your income? Or maybe you’ve used your savings account to fund a vacation, even though that money was meant for an emergency? This is mental accounting, our tendency to treat money differently depending on where it... Continue Reading →

Hyperbolic Discounting 101: Why We Prefer Instant Gratification Over Long-Term Rewards

We’ve all been there: The temptation to spend now rather than save for the future is real. Whether it's indulging in a late-night snack, skipping the gym for a Netflix binge, or splurging on a new gadget instead of putting money into savings, we often find ourselves making decisions that feel good in the moment,... Continue Reading →

Opportunity Cost 101: The Hidden Cost of Every Financial Decision

Have you ever wondered whether you made the right choice when you decided to spend your money or time on something? It's easy to focus on what we gain from a decision, but there's always something we're giving up when we make a choice. This hidden cost is known as opportunity cost. In this article,... Continue Reading →