Warren Buffett, the "Oracle of Omaha," is often seen as one of the greatest investors of all time. But how did he build such a colossal fortune? The answer lies in a combination of patience, understanding the time value of money, and making smart investments that compound over decades. In this article, we’ll break down:... Continue Reading →

How to Think Like a Business Owner (Investor): Building Wealth by Taking Control

Why Adopting an Entrepreneurial Mindset Can Lead to Smarter Investments and Financial Success Introduction: Thinking Like a Business Owner When most people think of investing, they focus on buying stocks or mutual funds and hoping for the best. But the most successful investors, like Warren Buffett and other self-made millionaires, approach their investments with the... Continue Reading →

How to Think Like an Investor: Peter Lynch’s Approach to Stocks

Why Adopting the Mindset of Peter Lynch Can Transform Your Investing Strategy The Power of Investing with Conviction When it comes to investing in the stock market, one name that stands out is Peter Lynch. Known for his remarkable success as the manager of the Fidelity Magellan Fund, Lynch made a name for himself by... Continue Reading →

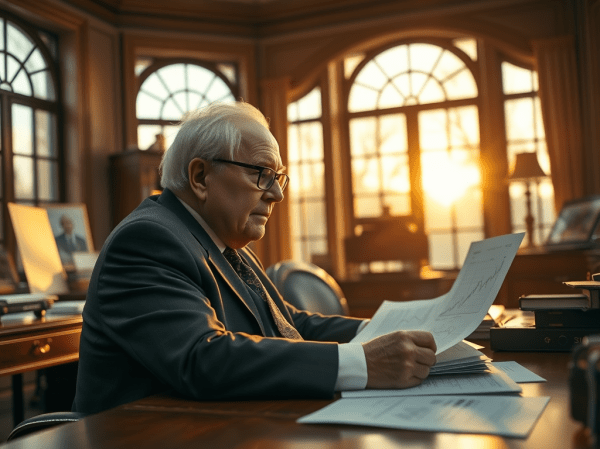

How to Think Like an Investor: Warren Buffett’s Approach to Success

Why Adopting the Mindset of a Long-Term Investor Can Change Your Financial Future The Power of Long-Term Thinking When it comes to investing, there’s one name that stands out above the rest: Warren Buffett. Known as the “Oracle of Omaha,” Buffett is one of the richest people in the world and has built his fortune... Continue Reading →

The Psychology Behind Risk Tolerance: Why You Might Be Taking More or Less Risk Than You Should

Risk tolerance is a term we hear often in investing, but it’s more than just a number on a form or a quick survey you fill out when setting up your portfolio. It’s deeply personal and rooted in psychology. Why do some investors take high risks with their money, while others are incredibly cautious? The... Continue Reading →

The Chess Analogy: Rational Investing in a World of Emotional Markets (Part II)

Investing in the stock market is much like a game of chess. At the outset, a player might have to decide on the first few moves, assessing the value of each piece on the board. Similarly, investors must evaluate the value of stocks, understanding their strengths and weaknesses before making a move. This is where... Continue Reading →

The Chessboard of Investing: Getting Rich Without Hurting Others

In the world of investing, there's a well-known saying: "Be fearful when others are greedy, and greedy when others are fearful." This quote from Warren Buffett is more than just a catchy phrase—it’s a proven approach to investing. It’s not about chasing quick profits or making impulsive moves. Instead, it’s about thinking strategically, like a... Continue Reading →

The Shift in My Approach to Reading That Changed My Investing Strategy

I came across this Google Doc I wrote years ago, which started as a conversation in ChatGPT. As someone who’s loved reading for as long as I can remember, I was a Hooked on Phonics kid—probably due to my dyslexia, which I didn’t know I had at the time. I always thought it was because... Continue Reading →

Charlie Munger, Ben Graham, and the Cigar Butt Approach to Investing: A Long-Term Strategy for Success

Introduction: The Wisdom of Charlie Munger and Ben Graham’s Cigar Butt Strategy I was reading a library book on the bus on the ride home after picking up my teen some breakfast cereal and gaming snacks, and I came across this wisdom from Charlie Munger on Ben Graham and cigar butts. It really got me... Continue Reading →

Why Fundamentals Matter More Than Stock Prices

As I was getting my laundry ready today, I came across a stock headline about Kenvue, the spinoff from Johnson & Johnson. A financial analyst dropped their price target to $26 per share, and it got me thinking—this is exactly why fundamentals should be the focus for any value investor. At the end of the... Continue Reading →