The Hype Train and Its Consequences On November 11, 2024, I wrote: "I just read something that said sell out of all your investments. My automatic response was ‘nope.’ Look, no matter what happens, there will be ups and downs in the market, and sometimes things will get ugly. Shit, I am scared too. But... Continue Reading →

Familiarity Bias in Investing: The Peter Lynch ‘Buy What You Know’ Effect—Helpful or Harmful?

Why Investors Favor What They Know Have you ever invested in a company just because you love its products? Maybe you stocked up on Apple shares because you use an iPhone or grabbed some Starbucks stock because you can’t start your day without a Venti latte. If so, you’ve experienced familiarity bias, a common behavioral... Continue Reading →

Understanding Mr. Market: The Manic Friend You Should Keep at a Distance

Introduction: Mr. Market and His Mood Swings Investing legend Benjamin Graham introduced one of the most useful mental models for understanding the stock market: Mr. Market. He’s an emotional, unpredictable friend who constantly changes his mind about what stocks are worth. Some days, he’s euphoric, pricing everything sky-high. Other days, he’s deeply depressed, selling stocks... Continue Reading →

Charlie Munger, Ben Graham, and the Cigar Butt Approach to Investing: A Long-Term Strategy for Success

Introduction: The Wisdom of Charlie Munger and Ben Graham’s Cigar Butt Strategy I was reading a library book on the bus on the ride home after picking up my teen some breakfast cereal and gaming snacks, and I came across this wisdom from Charlie Munger on Ben Graham and cigar butts. It really got me... Continue Reading →

Why Fundamentals Matter More Than Stock Prices

As I was getting my laundry ready today, I came across a stock headline about Kenvue, the spinoff from Johnson & Johnson. A financial analyst dropped their price target to $26 per share, and it got me thinking—this is exactly why fundamentals should be the focus for any value investor. At the end of the... Continue Reading →

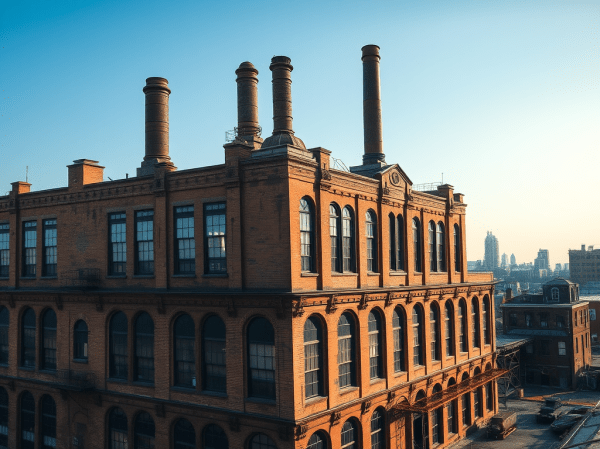

Simplified Investing: How Warren Buffett, Charlie Munger, and Ben Graham Made Investing Simple

Investing doesn’t need to be complicated. Over the years, I’ve come to realize that some of the best investors—like Warren Buffett, Charlie Munger, and Ben Graham—embrace a straightforward, almost old-school approach to evaluating businesses. They focus on quantitative and qualitative factors that anyone can understand, without getting bogged down in intricate financial models or projections... Continue Reading →

The Time I Almost Sold My Investments—And Why I Didn’t

Investing Isn’t Just Numbers—It’s a Mental Game I’ve never actually come close to selling my investments, but I’d be lying if I said the thought never crossed my mind. There have been moments—especially during the election year and the current administration —where I’ve sat there thinking, Should I even have my money in the market... Continue Reading →

Getting Rich Off “Go Woke, Go Broke” Companies

Something I’ve noticed in the last couple of years is how people are confusing their political views and personal beliefs with the success of publicly traded companies. This is severely misguided. While they’re focused on boycotting Disney for catering to an inclusive fan base or claiming Nike is doomed because of its social stances, they... Continue Reading →

The Dangers of Following the Herd, Keynes and Market Behavior

John Maynard Keynes once said:"It is not a case of choosing those [faces] that, to the best of one's judgment, are really the prettiest, nor even those that average opinion genuinely thinks the prettiest. We have reached the third degree where we devote our intelligences to anticipating what average opinion expects the average opinion to... Continue Reading →