I deleted this on Medium from the days when I would document my journey on there. I wrote this on Jan 27th, 2022. But now republishing it on here, due to inspiration from a previous post- Why I became an investor and started the broke college student blog. This time around, I am writing... Continue Reading →

Investment Wisdom for College Students: Navigating Stocks, ETFs, and Market Realities

Often as I write here, I realize that everyone is at different stages in their investing journey. Some are far ahead of me, while others are just starting out. However, the main focus of this blog remains on being a broke college student, a demographic I belong to—though perhaps not broke in the traditional sense.... Continue Reading →

Why I Became an Investor and Started the Broke College Student Blog

The scary truth and the real reason why I live like a broke college student even when I don't have to is rooted in a time in my life when the saying "I don't have a pot to piss in" was painfully true. I was terrified to my core during a period when my income... Continue Reading →

Dealing with Conflicting Thoughts, Ethics and Morals as an Investor

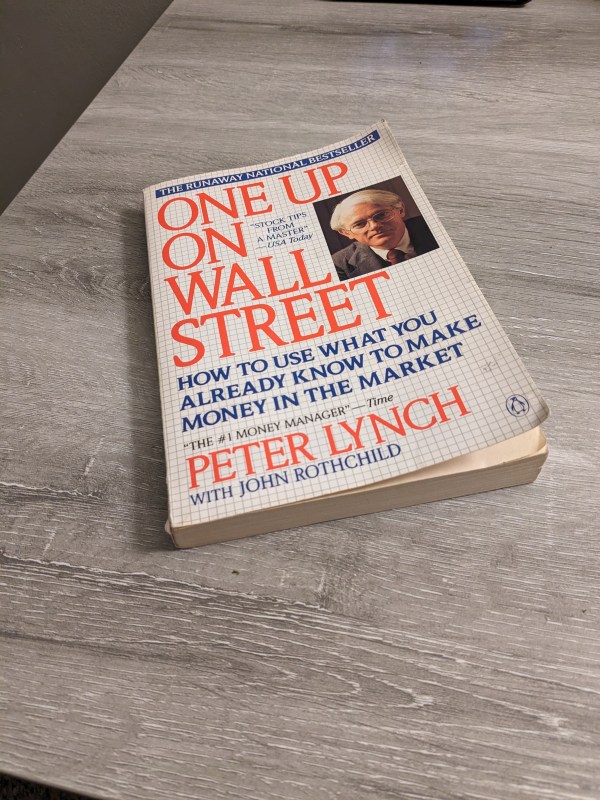

I was reading "One Up On Wall Street." I am nearing the end and am on page 218. As I was reading, I came across the sentence: "If you find a business that can get away with raising prices year after year without losing customers (addictive products such as cigarettes fill the bill), you've got... Continue Reading →

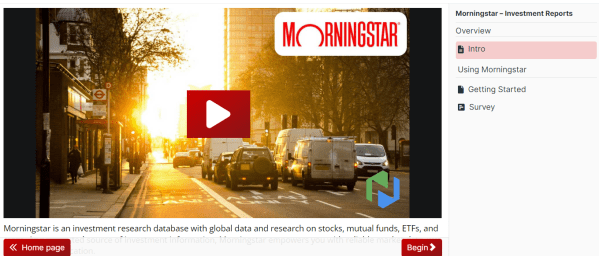

Some of the Greatest Investors Built Their Wealth Through Libraries; I Hope to Become One of Them

"What does a secret millionaire like Ronald Read, who passed away with a stealth fortune of $8 million, have in common with your local library? The answer is that your local library probably has Morningstar or Value Line, two great investment platforms that allow library card users to use their platforms for free to analyze... Continue Reading →

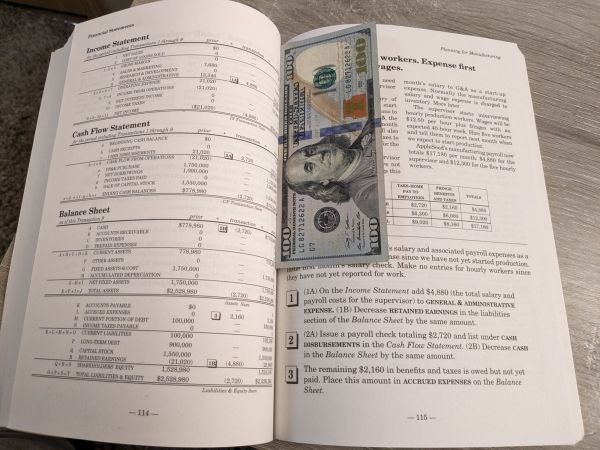

First Private Investment Fund; Starting From $0 at the Bottom of the Barrel

I pulled the trigger a bit late in the year on starting the fund. Truthfully, the idea to start the fund didn't come to me after the new year, it came sometime in late January. In October of 2023 I had taken a break from investing. With inflation combined with a low income I needed... Continue Reading →

Investing Comes Naturally to Me and That Makes It All the More Complicated

I also think this is why it is so hard for me to sometimes believe, investing, is something that has the ability to create financial security. Growing up, financial matters were a thing, money was often talked about, because there wasn't enough of it. People who didn't work would take from others. In my own... Continue Reading →

I Am Still Growing Into The Investor I Want to Become

Some of the BEST articles I read on investing, psychology, business and personal finance. Back in 2018 I came across a blog, ran by value investor Joshua Kennon. I spent two years reading and rereading articles by him and other investors. Before that there was a period in 2015 when I opened up my first... Continue Reading →

Even Large Corporations Still Struggle With This….

On the way to the grocery store to pick up peanuts, seaweed, chili, dish soap, greek yogurt, pasta and a pack of birthday cake oreos for a treat. As I was on the bus headed to pick up some groceries, I was reading Peter Lynch's One Up On Wall Street. There is a part where he... Continue Reading →

Listening To Peter Lynch’s Advice: Buy What You Know. Is Zevia Stock a Great Buy?

This is my first blog post. I wasn't sure how it was going to start off but as I was reading Peter Lynch's book One Up On Wall Street, the urge to write came around. Reading while watching a free YouTube Movie: Regarding Henry. One of my favorites. There is this company that I hold... Continue Reading →