When I walk outside, I often find myself picking up pennies. Many people overlook them, but I’ve come to realize the value of a penny. It’s a lost art to appreciate something that seems insignificant in the moment. But the truth is, these small steps add up to significant achievements over time. Small Investments Lead... Continue Reading →

43 Shares of Coca-Cola Now Sit on the Household Accounts

I sent $50 at the beginning of the month into our $KO position, which now has 43 shares, accumulating one additional share each year through dividend reinvestment. This has been the most rewarding position to date, extending beyond financial benefit. As I’ve mentioned numerous times on this site, Coca-Cola was the first company we invested... Continue Reading →

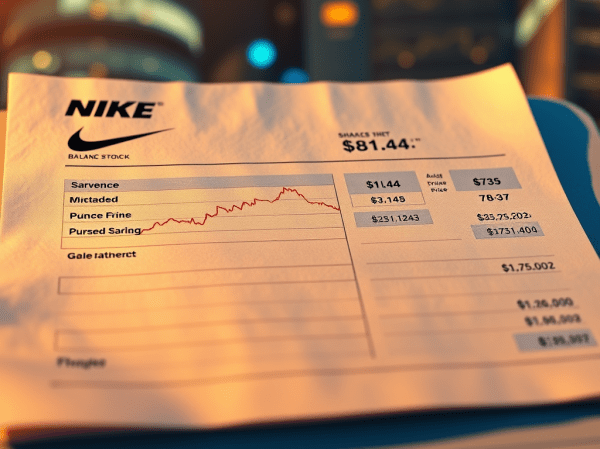

5 Shares of Nike Now Sit On the Balance Sheet

A while ago, I noticed something in the market—blue chip stocks were lower than usual. Nike was one of them. This was confirmed when one of my favorite investors who I see as a mentor posted an article supporting my suspicions. I started acquiring shares back in September. The first Nike share I ever purchased... Continue Reading →

A Chinese Fortune Cookie Lesson

The teen wanted Chinese takeout tonight and we got everything we wanted with no hesitation. It was what we both needed after a long month. Most of you that follow the blog know that I routinely eat at home because it is the most cost effective way to save money in our household, but tonight... Continue Reading →

Why Treating Your Investment Portfolio as Entertainment is a Costly Mistake

Trading in and out of positions is one of the best ways to lose out on capital appreciation and find yourself accumulating losses. Too many people confuse the stock market as some sort of get-rich-quick scheme, therefore treating it as an active source of entertainment. We have sports for that. Building wealth through the stock... Continue Reading →

The Importance of Independent Thinking in Investing

If you want a life different from everybody else, then you can't think like everybody else. This also applies to you as an investor. You won't have to go far to find someone telling you what to own, what to move, or what to manage in your own portfolio. For instance, I see users on... Continue Reading →

How to Think of Stock Ownership – Seeing Stock Market Opportunities Through a Business Lens

Yesterday I walked by McDonald's after picking up a hot deli lunch at Walmart for the first time. I had gone to grab a pair of new sweatpants. The weather is changing, and it's getting colder. I also found my stomach growling, so I picked up a couple of BBQ pork sandwiches and a Nathan's... Continue Reading →

You Have to Have Skin in the Game to Understand How the Stock Market Works

When I was at the fair yesterday, I was talking to the lady behind the counter at Fisher Scones. We both were excited about the free Coca-Cola bags, and she made sure to get one for every employee of hers. She told me she was a big collector of Coca-Cola, and I asked if she... Continue Reading →

Buying Back Time Through Dividend Investing

Yesterday was a fair day with the teen and a family friend. Coca-Cola was a big sponsor, and everyone who donated school supplies not only got in for free but was also given free Coca-Cola bags. Saying I was excited to see them as a big sponsor is an understatement. Once inside the gates, they... Continue Reading →

Understanding Trade and Opportunity Cost – Every Dollar Counts

There will always be things to buy. There will always be money to be spent. The world doesn't stop moving when you're sleeping. Money continues to flow in and out of people's hands 24/7—it's just how things work. Understand, there is no shortage of people happy to take your money, because exchanging a product for... Continue Reading →