Dividend investing was the initial strategy I chose to go with, with a concentrated focus on blue chip stocks. Think well-known names like Coca-Cola, Hershey, Disney, Shell, Starbucks, and Simon Property Group. It wasn't until 2021/2022 that I focused on adding some growth to my strategy and bought some ETFs like QQQM, FINX, SPTM, and... Continue Reading →

Peanut Butter Sandwiches and Profits: Exploring Stocks, Dividends, and the J.M. Smucker Company

Peanut butter sandwiches are becoming the foundation of the investment fund as I allocate more capital towards it to reach my year-end goal of $1,000 AUM. This has led me to read about the J.M Smucker Company and their tight grip on Jiffy. Growing up we were never a Skippy house or a Peter Pan... Continue Reading →

Market Timing vs. Strategy: Investing Beyond Nvidia Speculation and Choosing the Long Game

Over the course of the last year, we have seen tech companies dominate returns, especially with Nvidia driving the force of returns for investors. This has caused many investors and spectators to abandon their ships and try to climb aboard the full-speed-ahead Nvidia ship. This story isn't new, and Nvidia isn't the first siren call... Continue Reading →

Understanding the Power of Multiple Shares and Long-Term Investing

This might sound simple for those who are already in the investing world or have been on this journey for a while, but something I remember from when I started out is how surprised I was about capital appreciation through multiple shares. My purpose here is to explain this to those of you who are... Continue Reading →

Why Disney Has Been My Favorite Family Stock and Why I Never Plan on Selling Shares

My first share of Disney was purchased in 2020 on June 2nd at $118.98, and I dollar cost averaged down while it fell into the 90s. Dollar-cost average down for those that are new to the world of investing means I continued to buy while the price fell cheaper than the initial purchase price. It... Continue Reading →

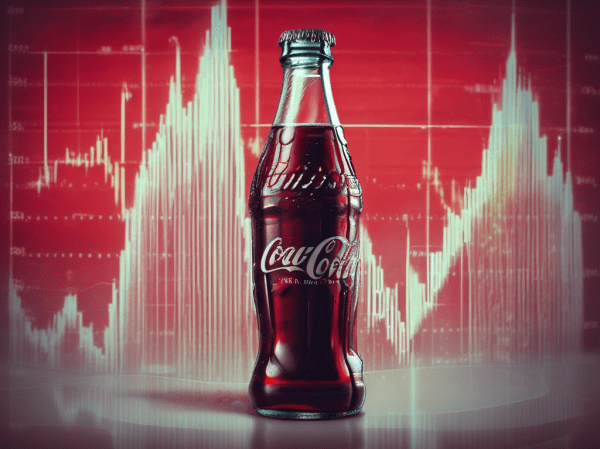

How Reinvesting Coca-Cola Dividends Gifts My Investment Portfolio with a ‘Free’ Yearly Share

Today, for the first time in a while, I logged into my Charles Schwab account and reviewed the dividend history for my first investment account. I wanted to check the recent dividends paid out, and to my pleasent surprise, Coca-Cola had paid dividends at the beginning of this month. When I looked closer, I noticed... Continue Reading →

The Italian Chocolate Company Ferrero Rocher and the Reason I Want to Own Shares

And why this chocolate empire should never go public. Photo by Mira Metzler on Unsplash Ever since the first time I unwrapped the gold foil off the chocolate hazelnut shell, where a delicate wafer encased a delectable chocolate cream surrounding a perfect whole hazelnut, causing the flavors to dance around my taste buds, I was... Continue Reading →

Why I Love Owning Shares of The Hershey Company and Why I’ll Never Sell Them

Note to readers before reading: I deleted this post on Medium from the days when I would document my journey on there. I wrote this on Jan 30th, 2022. But now republishing it on here 7/19/2024 and will be adding additional updates for this article at the bottom. I purchased my first share of the... Continue Reading →

One Up On Wall Street Summary In-Depth Analysis for College Students

I bought my first copy of One Up On Wall Street back in 2020. It took me until this year to read through it. https://youtu.be/s3jzbKW24jw?si=bYyCkaGra7a7Kr2r One of my favorite YouTube channels The Swedish Investor has some of the best book summaries, so I included his summary of the book here as well. It's funny how... Continue Reading →

How Buying Beef Jerky Reminded Me of the Power of Dividends

I can buy a share of Coca-Cola for that," I jokingly said to the store manager after asking him where the beef jerky was. I had seen the brand I wanted up front, but it was a larger size and priced at $30. The conversation went like this: "Are you sure you don't want that... Continue Reading →