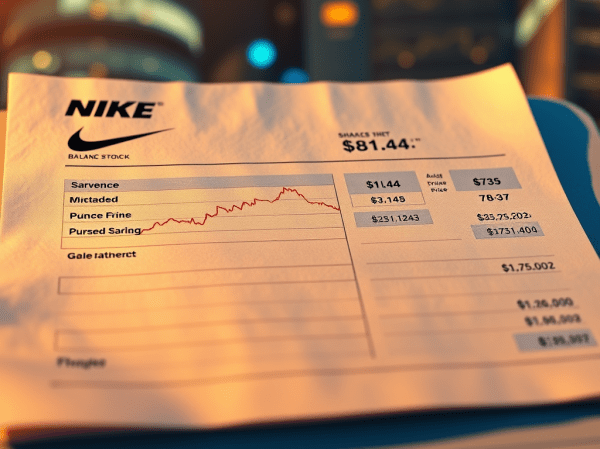

The investment fund now has 10 shares of Nike stock on the balance sheet. With current market fluctuations, certain companies are available at a great discount. Kenvue now has 31 shares, with an average cost basis of $21.89. It’s been an interesting experience so far, watching the market move and seeing solid companies fall into... Continue Reading →

How I Manage My Investment Fund Portfolio While Living in a One-Bedroom Apartment

This year, I started my private investment fund with the goal of it becoming a serious fund over the next decade. When I first started, I had $0 AUM (assets under management) outside of personal household accounts. The first funds I sent were $53 into VOO because I was still researching quality businesses that I... Continue Reading →

5 Shares of Nike Now Sit On the Balance Sheet

A while ago, I noticed something in the market—blue chip stocks were lower than usual. Nike was one of them. This was confirmed when one of my favorite investors who I see as a mentor posted an article supporting my suspicions. I started acquiring shares back in September. The first Nike share I ever purchased... Continue Reading →

Why I’m Buying Kenvue Stock for the Investment Fund

Thanksgiving break is coming up, and for the first time in a long time, I had a full day to myself, which allowed me to take a look at the balance sheet for the investment fund. At the time of this writing, $1,426.65 sits on the balance sheet in assets. Kenvue makes up $629.23, with... Continue Reading →

Private Fund Update – $1,000 in Assets Now Sits on the Balance Sheet

$1,000 now sits on the investment fund's private balance sheet with an annual income of $24.75, which will turn into $26.35 either this week or sometime next month from a couple more share purchases. I am excited to announce that this milestone was hit within the deadline because it allows me to move towards the... Continue Reading →

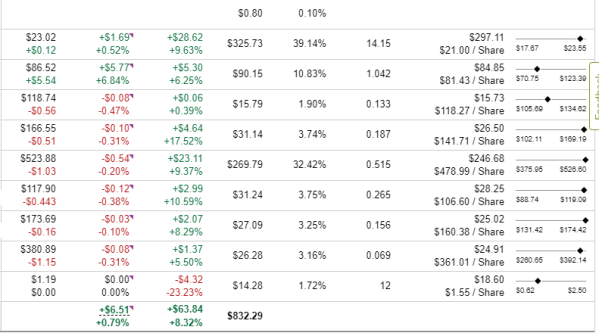

Private Fund Update – $830 AUM on Track to $1,000

I wasn't sure if I was going to write this update, but as you can see, the private fund is now at $830 in assets under management and should hit the target goal of $1,000 before the end of the year. I went ahead and calculated the rest of the $5 allotment for the month... Continue Reading →

Managing Portfolio Weighting For The Investment Fund – Staying Focused on Fundamentals

Good morning readers, it is 8:40 AM on a Monday morning, and it feels nice to be up this early as it has taken me a while to get back to a decent sleep schedule. I woke up early, ready to buy more shares of a certain company for the investment fund, and added a... Continue Reading →

Private Fund Update – Steady Progress Towards $1,000 AUM

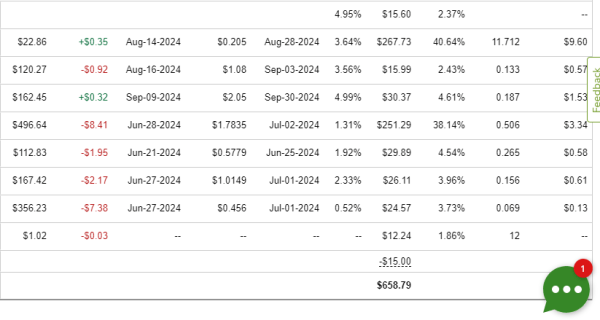

The private investment fund has now reached $658 assets under management, and the annual income for the fund is $16.36. The targeted goal is $1,000 AUM by the end of the year, December 31st, 2024. If you’ve been following along, you can see that the $5 contributions, which are on a daily schedule, are adding... Continue Reading →

Contributing $5 Daily to My Private Investment Fund Through the Remainder of 2024

If you've read a few of my blog posts, you'll know that I am minimalistic with the things I own. In December 2022, I came up with the idea to invest $5 daily for Christmas instead of buying things I didn't want. If you've ever seen the movie Christmas with the Kranks, that was pretty... Continue Reading →

Investment Fund Reaches $500 AUM Halfway to Year-End Goal

My private investment fund now has $500aum, which is halfway to the goal of $1,000 by the end of the year. I'm also happy to say that I now have an official name for it, though I won't be divulging it here just yet. It's new, and I don't have ownership of the name yet,... Continue Reading →