There are those defining moments in life. The moments you use to wait and wish for during some of your darkest hours. And I had one of mine today. I've been taking a personal finance class at the University of Washington Tacoma, taught by two Professors, Kirk Mandlin and Dean Bennion. Tonight was the first... Continue Reading →

Honoring My Late Mentor on a Monday Afternoon, While Reflecting on Wealth Building

It's a Monday late noon, and I am sitting in a café that myself, my mentor, and my son used to frequent together. I hadn't stepped in it since the beginning of the year, and when I did, it was only for a brief while to get food to take home. However, as the kid... Continue Reading →

Finding Home in Finance: A Reflection on Habits, Patience, and Mastery

There comes a moment in life when things click into place. For me, it wasn’t a sudden epiphany; it was a slow dawning, a series of small wake-up calls that finally added up. I’ve been in school since April 2024, putting every ounce of energy into my classes, trying to prove something to myself, maybe... Continue Reading →

Helping the Ready: What the $300 Dog Taught Me About Letting Go

(A Reflection on Financial Readiness, Boundaries, and Emotional Bandwidth) Realizing You Can’t Help Everyone Financially I used to think that if you cared enough, you could help anyone. I don’t believe that anymore. Recently, a friend of mine was thinking about adopting a dog as a Christmas present for her son, a $300 expense, while... Continue Reading →

Why People from Hard Backgrounds Are the Prime Targets of MLMs (And What No One Tells Them)

When you’ve spent your whole life just trying to survive, the first time you can breathe feels like wealth. You’ve paid down a few bills, maybe built a small cushion. For once, you’re not checking your bank app every morning to make sure you didn’t overdraft. That small moment of peace is exactly when the... Continue Reading →

What Seneca Would Say About Your Financial Life

Saving, Investing, and Living Without Debt, A Letter from the Stoics to the Modern World “It is not the man who has too little, but the man who craves more, who is poor.”— Seneca Somewhere between the noise of modern finance and the quiet hope of a better life, there’s a voice that still echoes... Continue Reading →

Margin of Error: When a Lost Debit Card Stops Being a Disaster

On Saturday, the phone rang, waking me out of my sleep. It was the 24/7 fraud prevention team at my credit union. Someone had run a $65 charge through a company called City Sightseeing in Washington, D.C. That would’ve been a neat trick, since I live in Washington State and haven’t been on a bus... Continue Reading →

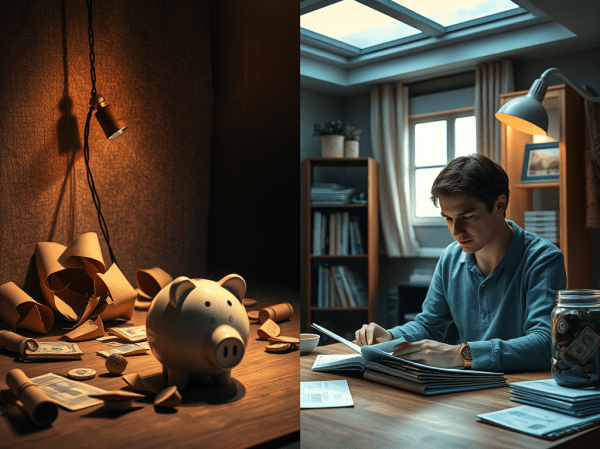

Pretend Rich: The Hidden Cost of Looking Financially Stable When You’re Not

You show up to work in clean clothes. You say “I’m fine” when your rent’s late. You bring snacks to the potluck even though you had to stretch $13 to make it happen. You keep the car clean, even though you’re two months behind on the insurance. You’re not rich. You’re not even “okay.” But... Continue Reading →

Circumstances vs. Choices: The Quiet Math of Wealth

Most people think wealth is a matter of luck, a high salary, or being born into the right family. And sure, circumstances matter. They always have. Some people start three steps behind because of poverty, illness, layoffs, or a thousand things outside their control. But here’s the truth few want to admit: once money actually... Continue Reading →

Financial Rule of Thumb: Only Spend What You Can Replace

My Rule of Thumb I have this rule of thumb: if I can’t replace something out of savings, or if I can’t replace what I spend within a few months, I don’t spend it. The reason for that is because, over the years, I’ve noticed a pattern with people who get windfalls or lump sums.... Continue Reading →