How did we get so entitled? I came across this question on a popular financial blog in the personal finance realm, and it prompted me to reflect on how our standards of living have gradually consumed us over time. Can we solely blame ourselves? The answer is both yes and no, but delving deeper into... Continue Reading →

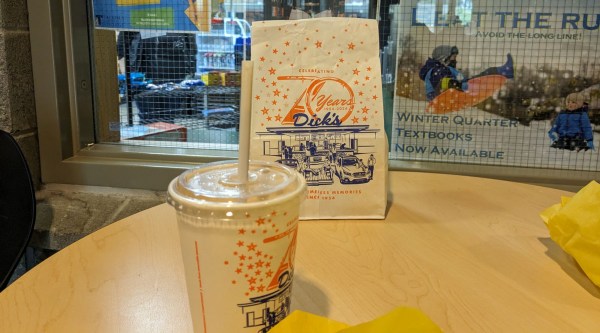

A Rare College Experience: Dick’s Hamburgers for Lunch on Campus

This blog post was supposed to be published at the start of spring quarter, April 11th to be exact, but I got busy. I wrote a bit about how I was saving money and not planning to spend much on campus. However, there was one event I couldn't miss, Dick's food truck on campus, famous... Continue Reading →

Understanding Credit Card Debt: A Guide for College Students

Credit card debt is one of the reasons why many people, especially those who are poor or considered low income, can't get ahead. Credit card companies and banks often target us with endless offers, and you've probably been receiving credit card envelopes in your mailbox since you turned 18. If you just turned 18, here's... Continue Reading →

The Student Loan Trap: Tips for Broke College Students

As a broke college student, the allure of student loans can be strong. When you're accustomed to seeing maybe just $100—or even as little as $5—in your bank account, discovering that you're eligible to borrow $4,000 or more in student loans can be incredibly tempting. However, it’s crucial to carefully consider this option, especially if... Continue Reading →

Embracing Change: My Journey to Online Income Despite Past Failures and Fear

I spent the majority of my young adult life focusing on predictability because my childhood was unpredictable causing me to be terrified of the unknown If I couldn't guarantee a certain outcome, result, I wrote it off because it was safer to stay in the known. I knew that if I didn't take certain risks,... Continue Reading →

Unlearning Behavior That Hinders Financial Growth; Not Every Sale Is One You Need to Be Apart Of

Walking home from the grocery store after spending $65 on groceries triggered a moment of insight. I often struggle with operating from the framework of buying what I need versus what I think I might need. Even if I need it down the road, I often buy it in the moment so it doesn't run... Continue Reading →