I want to speak to those of you who’ve ever lived by this thought: "If I pull x amount from savings, yet I can’t replace it within a certain time frame, perhaps I probably shouldn't." If that’s you? You’re doing what most people never learn to do. You're not just “saving”, you’re calculating the opportunity... Continue Reading →

The Law of Financial Inertia: Why Your Money Moves Like Matter

You don't need to be a physicist to understand why some people stay broke for decades while others quietly build wealth in the background. You just need to understand a little bit of motion, and a whole lot of human behavior. In physics, Newton’s First Law says an object in motion stays in motion unless... Continue Reading →

What the Time Value of Money Looks Like When You’re Broke

What the Textbooks Say In every finance class, there comes a moment when the professor introduces a golden rule: "A dollar today is worth more than a dollar tomorrow." It's a foundational concept, a building block of modern economics known as the time value of money. The idea is simple in theory: money loses value... Continue Reading →

Why I Chose My Portfolio Over a Car (And Never Looked Back)

A quiet case for walking, long-term wealth, and freedom on your own terms For the first time this year, I have been leaving my teenager alone. He used to go to school until he was about 8, but after that, we’ve always been together because of homeschooling. He’s never really been on his own, besides... Continue Reading →

Update on the Blog: No Monetization Pressure, But I Still Built This with Purpose

I started this blog on March 5th, 2024. It’s now June 22nd, 2025. That’s over a year of showing up, creating content, building something that wasn’t there before, and doing it whether or not anyone was reading. I’ve spent that portion of my life just creating. Whether it was through my own hands, physically typing... Continue Reading →

It Started with a Letter to Santa: Eggnog and a Million Dollars, a Life of Investing

I once wrote a letter to Santa that said, “All I want is a box of eggnog and a million dollars.” I spelled my name backwards in the signature because I was that young and dyslexic. My mom saved it. I threw it away later in a PTSD-driven moment trying to forget my childhood. But... Continue Reading →

Maya’s Financial Case Study: A Letter on Building Late, But Not Too Late

To the readers of this blog, Each year, Warren Buffett begins his annual letter not with a market prediction, but with a story. I’ll do the same. Let me tell you about Maya. Maya is fictional, but only technically. She exists in spirit all around us, in a sister, a coworker, a neighbor, or even... Continue Reading →

Financial Maintenance: The Quiet Habits That Preserve Wealth Over Time

Everyone talks about how to make money. But very few talk about how to keep it. We glorify the big wins, your first investment, your side hustle taking off, landing that promotion. We celebrate the breakthrough moments. But the truth is, wealth isn’t built in a moment. It’s built in the maintenance. Financial maintenance is... Continue Reading →

Money Maps: How Different Cultures Define Wealth, Risk, and What It Means to Have Enough

What does it mean to be rich? Ask that in America, and most people will answer with a number, $1 million, $5 million, “enough to never worry again.” But ask the same question in other parts of the world, and the answer shifts. In some places, being rich means having a home full of people... Continue Reading →

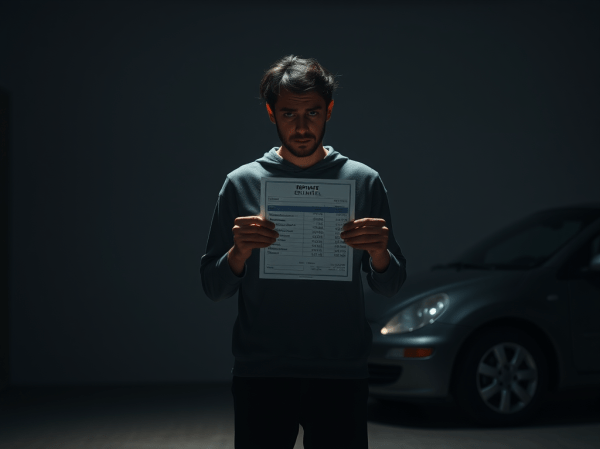

Financial Loneliness: What It Feels Like to Build a Life Without a Safety Net

Your car breaks down. The repair is $1,200. You stare at the estimate, phone in hand, and realize there’s no one to call. Not because you’re too proud. Not because you’re irresponsible. But because there is no one. Financial loneliness is the feeling of being utterly alone in your money life. No co-signer. No backup.... Continue Reading →