My Rule of Thumb I have this rule of thumb: if I can’t replace something out of savings, or if I can’t replace what I spend within a few months, I don’t spend it. The reason for that is because, over the years, I’ve noticed a pattern with people who get windfalls or lump sums.... Continue Reading →

Saving Money While Living for the Now: How to Build a Future Without Abandoning the Present

The False Choice Between Now and Later There’s a story people tell themselves about money. It goes like this: You either save and sacrifice the present, or you live in the moment and sacrifice the future. Pick your poison: regret or restriction. But what if that story isn’t true? What if saving money isn’t about... Continue Reading →

The Psychological Benefits of an Emergency Fund: How Financial Security Improves Mental Well-being

When people talk about building an emergency fund, they often focus on numbers and budgeting. But the real value of having one goes way beyond just protecting your bank account. An emergency fund can do wonders for your mental health, too. It helps reduce stress, boosts your confidence, and gives you a sense of security.... Continue Reading →

The Ultimate College Student’s Guide to Saving Money (Without Missing Out)

College is one of the most exciting (and expensive) times in life. Between tuition, books, food, and social events, it’s easy to blow through your budget without even realizing it. But here’s the good news: you don’t have to be broke in college. With the right strategies, you can save money, avoid financial traps, and... Continue Reading →

Why Your Savings Account Isn’t Growing (And What to Do About It)

If you’ve been faithfully putting money into your savings account and have been waiting for it to grow, you might be feeling a bit disappointed. After all, you’ve probably been seeing very little return on your hard-earned cash. The problem is, traditional savings accounts often don’t offer the growth potential you need to build long-term... Continue Reading →

The True Cost of Convenience: Are You Paying Extra for Your Favorite Online Subscriptions?

Subscriptions have become a significant part of modern life. From streaming services like Netflix and Spotify to food delivery apps and fitness subscriptions, we’ve grown accustomed to the convenience of paying a monthly fee for access to goods and services. But while these subscriptions provide instant gratification, they often come with hidden costs that can... Continue Reading →

The Rising Cost of Eggs, Toilet Paper, and Streaming: Why Cutting Back on Food Cost is the Ultimate Savings Hack

The Reality of Inflation and Everyday Costs Inflation has hit nearly every aspect of our daily lives. From the cost of eggs to the price of toilet paper, it seems like basic necessities are getting more expensive by the day. Meanwhile, what we once considered luxuries—like streaming services and eating out—have become ingrained in our... Continue Reading →

How Cutting Down on Grocery Stores Helped Me Save Money and Eat Better

Life gets complicated fast—too many choices, too many decisions, and too many distractions pulling us in different directions. Lately, I’ve been making a conscious effort to simplify, not just in terms of material clutter, but in my daily routines and habits. One area that’s made a big difference? Where I shop for groceries. The Trap... Continue Reading →

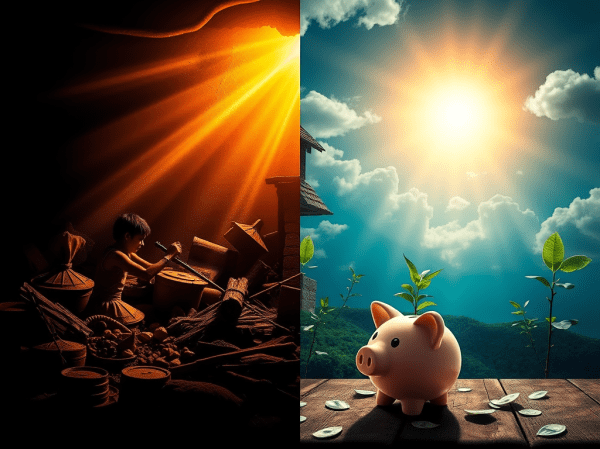

Maslow’s Hierarchy of Needs – Moving Beyond Survival Mode for Financial Security

The psychological concept of Maslow's Hierarchy of Needs teaches us that at the base of the pyramid, our most basic needs—food, water, shelter—must be met before we can focus on anything else. When you're living check to check, when you're in survival mode, your mental and emotional energy is consumed by just meeting those needs.... Continue Reading →

HYSA Rates Are Dropping—Here’s Why That Doesn’t Matter

Something people need to understand about High-Yield Savings Accounts (HYSAs) is that the 5% and 4% interest rates were never going to last. I've seen many people online complaining about their savings rates dropping and asking for advice on where to move their cash next. I think this is absurd. Once again, you have people... Continue Reading →