Thanksgiving break is coming up, and for the first time in a long time, I had a full day to myself, which allowed me to take a look at the balance sheet for the investment fund. At the time of this writing, $1,426.65 sits on the balance sheet in assets. Kenvue makes up $629.23, with... Continue Reading →

The Calvary Isn’t Coming in the Next Four Years

Elections have consequences regardless of who wins. The sooner you understand this, the better prepared you will be to protect your family and the livelihood you depend on to care for the ones you love. This election, however, will have dire consequences for decades to come for those who don't fit a certain cutout of... Continue Reading →

A Chinese Fortune Cookie Lesson

The teen wanted Chinese takeout tonight and we got everything we wanted with no hesitation. It was what we both needed after a long month. Most of you that follow the blog know that I routinely eat at home because it is the most cost effective way to save money in our household, but tonight... Continue Reading →

Battening Down the Hatches while Preparing for the Next Four Years

It's 12:06 am, and I finally sit down to write this while watching ABC's 9-1-1. I am not sure where to start except to say that we decided to batten down the hatches on our household like we did in 2020. Ever since the election, we have noticed a shift in our household, and we... Continue Reading →

Building a Future, No Matter Who’s in Office

I know it has been a while. School has kept me busy and away from this blog. This is the first week I’ve been able to have a few days to myself in a row. I can't help but wonder if my professors knew this election was going to be terrible for a lot of... Continue Reading →

Creating Halloween Memories in Our One-Bedroom Apartment

A couple of posts back I mentioned that the teen was going to have a Halloween party. I want to share that here as it was the first time I went all out and allowed him to put whatever he wanted into the cart to decorate our small one-bedroom apartment. This was the result. The... Continue Reading →

Why Treating Your Investment Portfolio as Entertainment is a Costly Mistake

Trading in and out of positions is one of the best ways to lose out on capital appreciation and find yourself accumulating losses. Too many people confuse the stock market as some sort of get-rich-quick scheme, therefore treating it as an active source of entertainment. We have sports for that. Building wealth through the stock... Continue Reading →

Private Fund Update – $1,000 in Assets Now Sits on the Balance Sheet

$1,000 now sits on the investment fund's private balance sheet with an annual income of $24.75, which will turn into $26.35 either this week or sometime next month from a couple more share purchases. I am excited to announce that this milestone was hit within the deadline because it allows me to move towards the... Continue Reading →

Today Was the First Day of Fall Classes

Today was my first day of fall quarter after waking up to purchase a couple of shares of Kenvue. I didn't sleep well last night because of the anticipation of knowing the fund was going to meet its target goal. This is probably why I was overwhelmed seeing all the reading assignments that need to... Continue Reading →

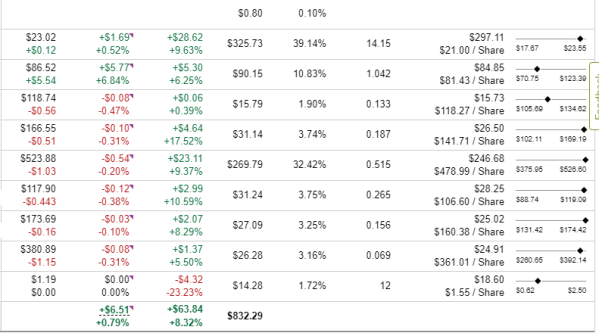

Private Fund Update – $830 AUM on Track to $1,000

I wasn't sure if I was going to write this update, but as you can see, the private fund is now at $830 in assets under management and should hit the target goal of $1,000 before the end of the year. I went ahead and calculated the rest of the $5 allotment for the month... Continue Reading →