Good morning readers, it is 8:40 AM on a Monday morning, and it feels nice to be up this early as it has taken me a while to get back to a decent sleep schedule. I woke up early, ready to buy more shares of a certain company for the investment fund, and added a... Continue Reading →

Private Fund Update – Steady Progress Towards $1,000 AUM

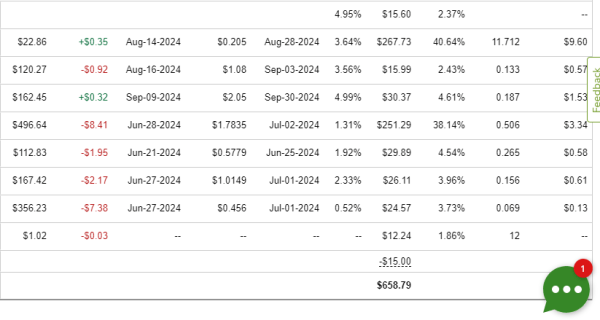

The private investment fund has now reached $658 assets under management, and the annual income for the fund is $16.36. The targeted goal is $1,000 AUM by the end of the year, December 31st, 2024. If you’ve been following along, you can see that the $5 contributions, which are on a daily schedule, are adding... Continue Reading →

You Have to Have Skin in the Game to Understand How the Stock Market Works

When I was at the fair yesterday, I was talking to the lady behind the counter at Fisher Scones. We both were excited about the free Coca-Cola bags, and she made sure to get one for every employee of hers. She told me she was a big collector of Coca-Cola, and I asked if she... Continue Reading →

Why I Don’t Regret Not Driving and Owning a Car

You think you are behind, but you are right where you want to be. This is the thought I had today as I was recalling conversations I had with a friend of mine who used to be one of my neighbors at an old apartment complex. It was my first apartment ever, and after a... Continue Reading →

Buying Back Time Through Dividend Investing

Yesterday was a fair day with the teen and a family friend. Coca-Cola was a big sponsor, and everyone who donated school supplies not only got in for free but was also given free Coca-Cola bags. Saying I was excited to see them as a big sponsor is an understatement. Once inside the gates, they... Continue Reading →

Bringing Food to the Fair to Save Money

The teen wants to go to the State Fair on Friday with a family friend, so I canceled everything on the calendar for that day so we can go and spend the day taking in the ambiance of the once-a-year fair. And if you know one thing about me, it's that you know I am... Continue Reading →

Understanding Trade and Opportunity Cost – Every Dollar Counts

There will always be things to buy. There will always be money to be spent. The world doesn't stop moving when you're sleeping. Money continues to flow in and out of people's hands 24/7—it's just how things work. Understand, there is no shortage of people happy to take your money, because exchanging a product for... Continue Reading →

Building Stealth Wealth – A Journey of Investments, Friendship, and Simple Dreams

There is something about acquiring shares of a certain company that most people around my age have no clue about because they don't care to, to be frank, which means there is more slice of pie for the balance sheet of the private investment fund. I was talking with a friend today who moved to... Continue Reading →

Balancing Budgets, Building Bonds, Financial Stability, and Fall Traditions

Fall season is approaching, and I am feeling at home once more as I pull out the fall decorations and Halloween decor over time. This year, I decided on throwing a Halloween party for my teenager and his tutor who has become a close family friend to the both of us. Every year I get... Continue Reading →

My Investment Strategy Over the Past 4 Years – What I’ve Learned and Applied

Dividend investing was the initial strategy I chose to go with, with a concentrated focus on blue chip stocks. Think well-known names like Coca-Cola, Hershey, Disney, Shell, Starbucks, and Simon Property Group. It wasn't until 2021/2022 that I focused on adding some growth to my strategy and bought some ETFs like QQQM, FINX, SPTM, and... Continue Reading →