To the readers of this blog, Each year, Warren Buffett begins his annual letter not with a market prediction, but with a story. I’ll do the same. Let me tell you about Maya. Maya is fictional, but only technically. She exists in spirit all around us, in a sister, a coworker, a neighbor, or even... Continue Reading →

Financial Maintenance: The Quiet Habits That Preserve Wealth Over Time

Everyone talks about how to make money. But very few talk about how to keep it. We glorify the big wins, your first investment, your side hustle taking off, landing that promotion. We celebrate the breakthrough moments. But the truth is, wealth isn’t built in a moment. It’s built in the maintenance. Financial maintenance is... Continue Reading →

Money Maps: How Different Cultures Define Wealth, Risk, and What It Means to Have Enough

What does it mean to be rich? Ask that in America, and most people will answer with a number, $1 million, $5 million, “enough to never worry again.” But ask the same question in other parts of the world, and the answer shifts. In some places, being rich means having a home full of people... Continue Reading →

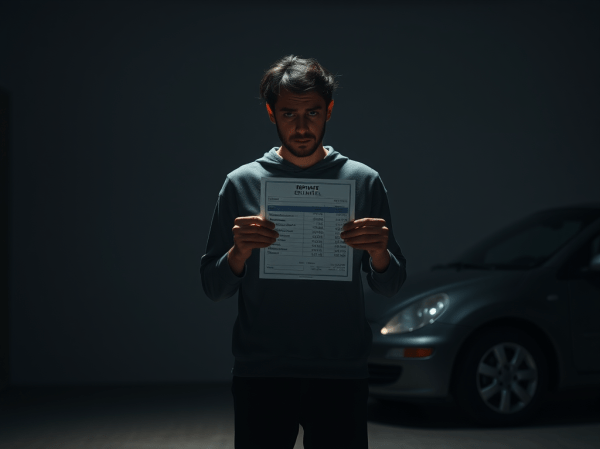

Financial Loneliness: What It Feels Like to Build a Life Without a Safety Net

Your car breaks down. The repair is $1,200. You stare at the estimate, phone in hand, and realize there’s no one to call. Not because you’re too proud. Not because you’re irresponsible. But because there is no one. Financial loneliness is the feeling of being utterly alone in your money life. No co-signer. No backup.... Continue Reading →

No One Ever Taught Me to Sit Still: The ADHD Economy and Why Focus Is Financial Power

You start a budget, then get distracted. You open your banking app, then close it without doing anything. You sign up for a money course, take notes for three days, then ghost it entirely. You feel guilty, tired, behind, and the worst part is, you knew better. But knowing and doing? Two different universes. In... Continue Reading →

Inherited Nervous Systems: How Financial Trauma Gets Passed Down Without a Cent

You didn’t inherit money. But you did inherit something. Maybe it wasn’t a house or an investment account. Maybe it was the way your stomach drops when your card declines. The way your shoulders tense every time rent is due. The way you feel the need to check your bank app, even if you just... Continue Reading →

The Cost of Being Believed: Why Financial Credibility Isn’t Free for Everyone

Some people walk into a bank and get offered a line of credit before they even ask. Others walk in with a folder full of paperwork, perfect grammar, clean clothes, and still get side-eyed like they’re there to rob the place. What’s the difference? It’s not always income. It’s not always debt. Sometimes, the biggest... Continue Reading →

Graduation Without the Gown: Quietly Celebrating Milestones in Your Own Way

Today I graduated. The weather didn’t make a scene about it. No grand speech, no band playing. I didn’t put on a cap and gown. I didn’t walk across a stage or pose for pictures with extended family. None of that happened. I was at home. I went to the mall, bought some chocolates, and... Continue Reading →

Money Guilt: How to Forgive Yourself for Past Mistakes

There’s a certain kind of silence that comes when you open your banking app and see less than you expected. It’s not panic. It’s a quiet, familiar weight. A knowing. A memory. You think about that money you spent, on takeout, on clothes, on a trip you probably shouldn’t have taken, or maybe on survival.... Continue Reading →

How to Build a Financial Life When You Were Raised in Survival Mode

If you grew up in survival mode, chances are money wasn’t just scarce, it was stressful, unpredictable, maybe even dangerous. Maybe your mom worked three jobs and still couldn’t keep the lights on. Maybe your dad drank away the rent money. Maybe you remember sneaking food into your backpack at school, not because you were... Continue Reading →