Note to readers before reading: I deleted this post on Medium from the days when I would document my journey on there. I wrote this on Jan 30th, 2022. But now republishing it on here 7/19/2024 and will be adding additional updates for this article at the bottom. I purchased my first share of the... Continue Reading →

A Personal Reflection of $3.59, and Lint Pockets— Hard Financial Times

I deleted this on Medium from the days when I would document my journey on there. I wrote this on Feb 15, 2022. I am now republishing it on here, however, I want to update this blog post at the end to current times as some things have changed and this blog is more current... Continue Reading →

How College Students Can Benefit from Understanding Compound Interest

Compound interest is the bane of existence for students, former and current; it's behind the debt snowball that just keeps getting bigger and bigger. It's the reason why the principal amount of debt is difficult to pay off. However, for those interested in personal finance, compound interest is where students can take back their power,... Continue Reading →

Why Movies Like The Curly Sue Movie Make Me Want to Be Wealthy

There's something about the score that plays right as the movie opens, and you see Curly Sue and Bill, her father, walking. This movie is one of those I mentioned in a previous post when I said that certain movies made me want to build wealth or achieve a certain degree of success. I think... Continue Reading →

One Up On Wall Street Summary In-Depth Analysis for College Students

I bought my first copy of One Up On Wall Street back in 2020. It took me until this year to read through it. https://youtu.be/s3jzbKW24jw?si=bYyCkaGra7a7Kr2r One of my favorite YouTube channels The Swedish Investor has some of the best book summaries, so I included his summary of the book here as well. It's funny how... Continue Reading →

I’m Challenging Myself to Become a B + Student With a 3.5 GPA Instead of an A Student

I understand that the title might seem backward, but let me explain. Last quarter, I got straight A's, and I was excited about it. It was something I wanted to do to prove to myself that I could do it. But, what I didn't realize was that chasing a high GPA would mean sacrificing other... Continue Reading →

My Frugal College Student Grocery List for Summer Quarter: Using Reward Points

Summer Quarter started on June 24th, and already it's July 10th. What I call my broke or frugal college student grocery list is drastically different than it was going into Spring Quarter. As I mentioned in the Spring Quarter post, snacking was going to be a main component of my eating while adjusting to a... Continue Reading →

How Buying Beef Jerky Reminded Me of the Power of Dividends

I can buy a share of Coca-Cola for that," I jokingly said to the store manager after asking him where the beef jerky was. I had seen the brand I wanted up front, but it was a larger size and priced at $30. The conversation went like this: "Are you sure you don't want that... Continue Reading →

Why Buying My First Share of Coca-Cola Stock Gave Me Peace of Mind

I deleted this on Medium from the days when I would document my journey on there. I wrote this on Jan 27th, 2022. But now republishing it on here, due to inspiration from a previous post- Why I became an investor and started the broke college student blog. This time around, I am writing... Continue Reading →

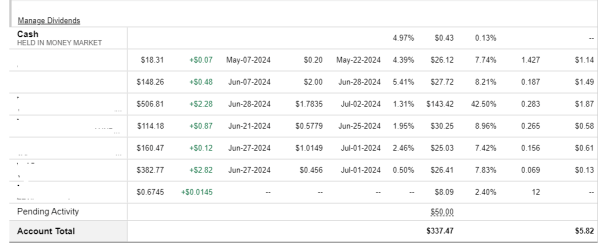

How Much Do I Earn From My Investment Fund While in College?

I just started the investment fund a couple of months ago, and getting straight to the point I barely earn any dividends as I am focusing on growing from the ground up - the current annual income for the fund is $5.82. The goal right now isn't to live off dividends while I'm in college;... Continue Reading →